NO.PZ2018111303000006

问题如下:

PZ company is an education company headquartered in China. It complies with IFRS. In 2018, PZ held a 20% passive equity ownership interest in

T-internet company. At the end of the 2018, PZ company decides to

increase its ownership interest to 50% and control over T-internet

company on 1 January 2019 through a cash purchase. There are no

intercompany transactions. The financial statement data for PZ company

and T-internet company in the following table:

Compared to PZ company’s operating margin in 2018, its operating margin in 2019 will be:

选项:

A. higher

B. the same

C. lower.

解释:

A is correct.

考点:不同的会计方法下对会计比率的影响

解析:2018年的PZ 公司投资在T公司是用financial asset的投资类型来记账,不按比例分享子公司的经营成果。直接就是3,000/5,000=60%。

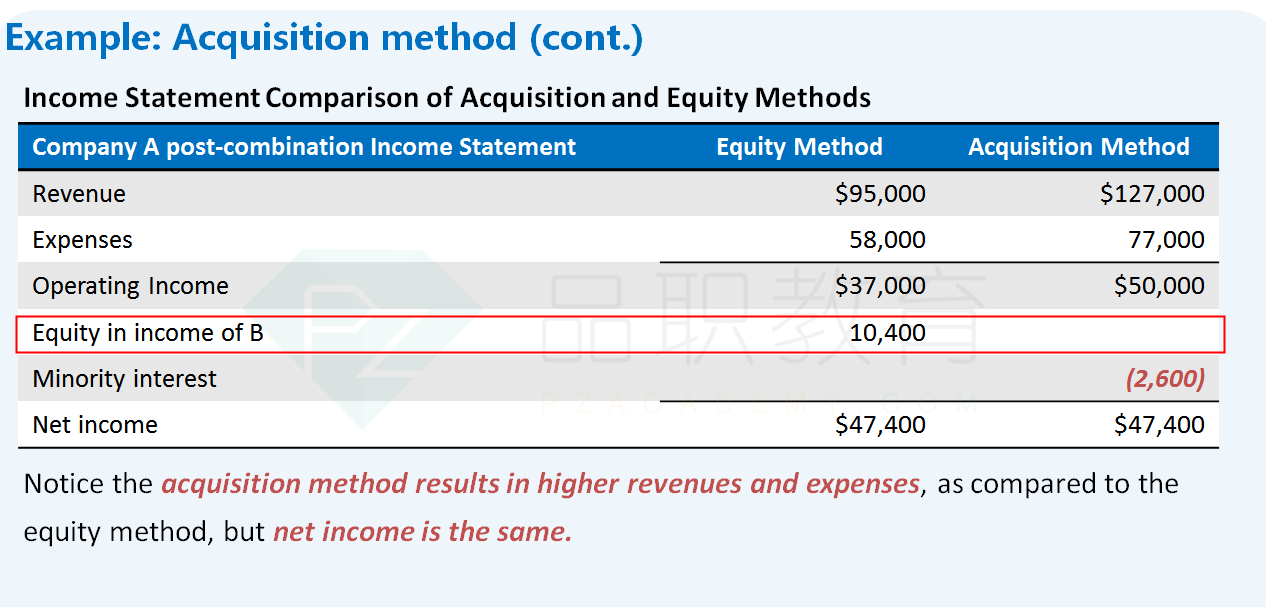

在2019年因为是acquisition method,所以合并子公司的损益表是百分之百合并,不需要乘以比例。Operating margin =(4,700+1,200)/(7,000+2,500)=62%

所以2019年的operating margin会更高.

如果2018用equity method计算结果如何?