问题如下图:

选项:

A.

B.

C.

解释:

这题有没有比答案更简单易得的思路呢

竹子 · 2018年02月04日

这一题的答案其实就是验证了套利的过程。

这一题已经告诉你需要short call option,但正常来说我们是需要判断是long call还是short call来套利。但就这一题来说,它已经告诉你是short call。在此基础上套利,套利就是risk free且自己不出钱。

首先 满足risk free: short call当股票价格下降时有风险,所以我们需要long stock来hedge。所以需要long stock而不是short stock,这样可以直接锁定B答案。

然后,一份call option需要delta份股票hedge,所以1份call option需要买0.6份股票hedge。short 1份 call option 可以拿到4.5,买入0.6份股票需要50*0.6=30,钱不够,所以需要borrow。

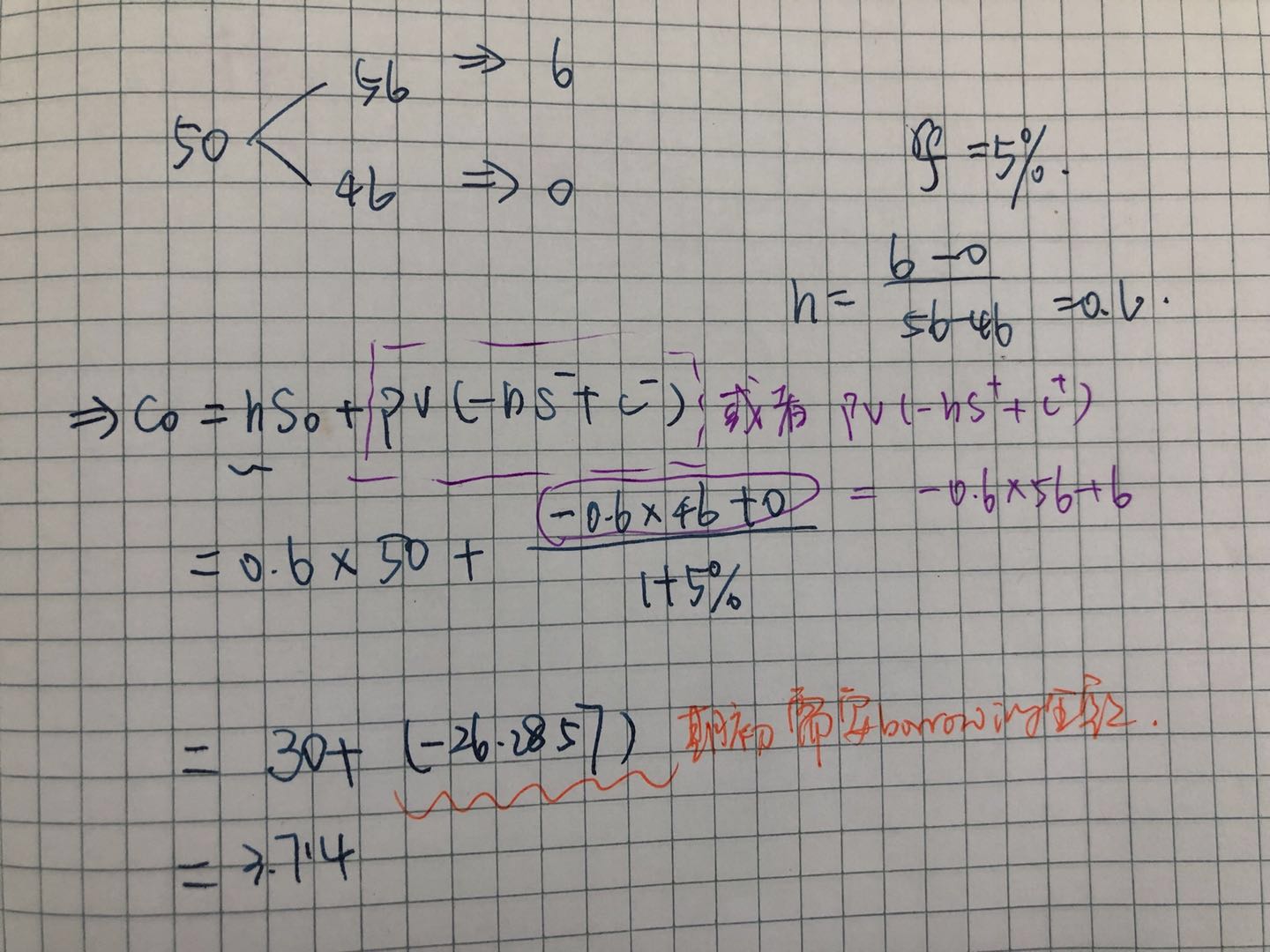

下面是计算call无套利状态下的价格的过程,其实这一过程就体现了上述的内容:

elizaben · 2018年02月04日

非常感谢,您写的过程非常清晰 明白了 谢谢老师。

粉红豹 · 2019年03月07日

老师,short call是股价上升时候有风险吧?不是股价下降时候有风险呀?

竹子 · 2019年03月08日

笔误,谢谢指出哈~

NO.PZ201702190300000304问题如下 For the Alpha Company option, the positions to take aantage of the arbitrage opportunity are to write the call an A.short shares of Alpha stoanlenB.buy shares of Alpha stoanborrow.C.short shares of Alpha stoanborrow. B is correct.You shoulsell (write) the overpricecall option anthen go long (buy) the replicating portfolio for a call option. The replicating portfolio for a call option is to buy h shares of the stoanborrow the present value of (hS- - c-).c = hS + PV(-hS- + c-).h = (- c-)/(S+ - S-) = (6 - 0)/(56 - 46) = 0.60.For the example in this case, the value of the call option is 3.714. If the option is overpriceat, say, 4.50, you short the option anhave a cash flow Time 0 of +4.50. You buy the replicating portfolio of 0.60 shares 50 per share (giving you a cash flow of -30) anborrow (1/1.05) x [(0.60 x 46) - 0] = (1/1.05) x 27.6 = 26.287. Your cash flow for buying the replicating portfolio is -30 + 26.287 = -3.713. Your net cash flow Time 0 is + 4.50 - 3.713 = 0.787. Your net cash flow Time 1 for either the up move or wn move is zero. You have ma arbitrage profit of 0.787.In tabulform, the cash flows are follows:中文解析根据题干信息可知,当前的市场上关于Alpha公司的看涨期权是被高估的,因此套利操作下我们可以卖出被高估的买进被低估的,因此正如本题问题中表述的已经卖出了看涨期权,然后需要的操作是买入一个合成的看涨期权。看涨期权的合成相当于借钱买股票,因此本题选我读懂了这道题要short call, 但我疑惑write the call是指啥?

NO.PZ201702190300000304 问题如下 For the Alpha Company option, the positions to take aantage of the arbitrage opportunity are to write the call an A.short shares of Alpha stoanlen B.buy shares of Alpha stoanborrow. C.short shares of Alpha stoanborrow. B is correct.You shoulsell (write) the overpricecall option anthen go long (buy) the replicating portfolio for a call option. The replicating portfolio for a call option is to buy h shares of the stoanborrow the present value of (hS- - c-).c = hS + PV(-hS- + c-).h = (- c-)/(S+ - S-) = (6 - 0)/(56 - 46) = 0.60.For the example in this case, the value of the call option is 3.714. If the option is overpriceat, say, 4.50, you short the option anhave a cash flow Time 0 of +4.50. You buy the replicating portfolio of 0.60 shares 50 per share (giving you a cash flow of -30) anborrow (1/1.05) x [(0.60 x 46) - 0] = (1/1.05) x 27.6 = 26.287. Your cash flow for buying the replicating portfolio is -30 + 26.287 = -3.713. Your net cash flow Time 0 is + 4.50 - 3.713 = 0.787. Your net cash flow Time 1 for either the up move or wn move is zero. You have ma arbitrage profit of 0.787.In tabulform, the cash flows are follows:中文解析根据题干信息可知,当前的市场上关于Alpha公司的看涨期权是被高估的,因此套利操作下我们可以卖出被高估的买进被低估的,因此正如本题问题中表述的已经卖出了看涨期权,然后需要的操作是买入一个合成的看涨期权。看涨期权的合成相当于借钱买股票,因此本题选 谢谢

NO.PZ201702190300000304问题如下 For the Alpha Company option, the positions to take aantage of the arbitrage opportunity are to write the call an A.short shares of Alpha stoanlenB.buy shares of Alpha stoanborrow.C.short shares of Alpha stoanborrow. B is correct.You shoulsell (write) the overpricecall option anthen go long (buy) the replicating portfolio for a call option. The replicating portfolio for a call option is to buy h shares of the stoanborrow the present value of (hS- - c-).c = hS + PV(-hS- + c-).h = (- c-)/(S+ - S-) = (6 - 0)/(56 - 46) = 0.60.For the example in this case, the value of the call option is 3.714. If the option is overpriceat, say, 4.50, you short the option anhave a cash flow Time 0 of +4.50. You buy the replicating portfolio of 0.60 shares 50 per share (giving you a cash flow of -30) anborrow (1/1.05) x [(0.60 x 46) - 0] = (1/1.05) x 27.6 = 26.287. Your cash flow for buying the replicating portfolio is -30 + 26.287 = -3.713. Your net cash flow Time 0 is + 4.50 - 3.713 = 0.787. Your net cash flow Time 1 for either the up move or wn move is zero. You have ma arbitrage profit of 0.787.In tabulform, the cash flows are follows:中文解析根据题干信息可知,当前的市场上关于Alpha公司的看涨期权是被高估的,因此套利操作下我们可以卖出被高估的买进被低估的,因此正如本题问题中表述的已经卖出了看涨期权,然后需要的操作是买入一个合成的看涨期权。看涨期权的合成相当于借钱买股票,因此本题选题干说了是short call,直接用ck=ps不就好了吗,感觉解析说的太复杂了吧

NO.PZ201702190300000304 问题如下 For the Alpha Company option, the positions to take aantage of the arbitrage opportunity are to write the call an A.short shares of Alpha stoanlen B.buy shares of Alpha stoanborrow. C.short shares of Alpha stoanborrow. B is correct.You shoulsell (write) the overpricecall option anthen go long (buy) the replicating portfolio for a call option. The replicating portfolio for a call option is to buy h shares of the stoanborrow the present value of (hS- - c-).c = hS + PV(-hS- + c-).h = (- c-)/(S+ - S-) = (6 - 0)/(56 - 46) = 0.60.For the example in this case, the value of the call option is 3.714. If the option is overpriceat, say, 4.50, you short the option anhave a cash flow Time 0 of +4.50. You buy the replicating portfolio of 0.60 shares 50 per share (giving you a cash flow of -30) anborrow (1/1.05) x [(0.60 x 46) - 0] = (1/1.05) x 27.6 = 26.287. Your cash flow for buying the replicating portfolio is -30 + 26.287 = -3.713. Your net cash flow Time 0 is + 4.50 - 3.713 = 0.787. Your net cash flow Time 1 for either the up move or wn move is zero. You have ma arbitrage profit of 0.787.In tabulform, the cash flows are follows:中文解析根据题干信息可知,当前的市场上关于Alpha公司的看涨期权是被高估的,因此套利操作下我们可以卖出被高估的买进被低估的,因此正如本题问题中表述的已经卖出了看涨期权,然后需要的操作是买入一个合成的看涨期权。看涨期权的合成相当于借钱买股票,因此本题选 老师,前面我都看懂了,在t=0时刻卖出被高估的看涨期权,买入合成的看涨期权,arbitrage profit=price-value=0.786,但是请问Your net cash flow Time 1 for either the up move or wn move is zero. 这句话是什么意思?

NO.PZ201702190300000304 1.这个题目没说是BSMmol ,看提问有的成了BSMmol。 1.1课件142页写的 call option =long stock+short bon以这道题?那这里的short 对应答案B里面的borrow bon为什么? 1.2不理解如果有put option这题的答案还有什么? 2.课件101页写的call=unlying anfinancing这里指代的是long call ?还是long或者short call? 3.课件102 页是long put,short sell the unrlying anlen?这里是这道题?可这题目说的意思short call,不是long put 4.因为overpricecall推出的short call? 5.那按照里的For the example in this case, the value of the call option is 3.714. 这个值是无套利定价下的合理价值? 6.能否一下答案里的例子答案,我就没明白时代1和0之间的变化。谢谢