请问,最大权限降低到40%,如何推出Sell $15 million of P2这个结论?

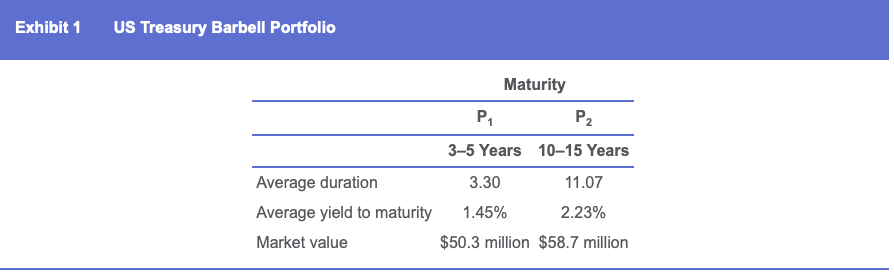

The bank’s proprietary fixed-income portfolio is structured as a barbell portfolio: About half of the portfolio is invested in zero-coupon Treasuries with maturities in the 3- to 5-year range (Portfolio P1), and the remainder is invested in zero-coupon Treasuries with maturities in the 10- to 15-year range (Portfolio P2). Georges Montes, the portfolio manager, has discretion to allocate between 40% and 60% of the assets to each maturity “bucket.” He must remain fully invested at all times. Exhibit 1 shows details of this portfolio.

Q. If Montes is expecting a 50 bp increase in yields at all points along the yield curve, which of the following trades is he most likely to execute to minimize his risk?

A: Sell $15 million of P2 and reinvest the proceeds in three-year bonds.