NO.PZ201709270100000308

问题如下:

8.If Varden’s beliefs about ROE and CEO tenure are true, which of the following would violate the assumptions of multiple regression analysis?

选项: The assumption about CEO tenure distribution only

The assumption about the ROE/dividend growth correlation only

C.The assumptions about both the ROE/dividend growth correlation and CEO tenure distribution

解释:

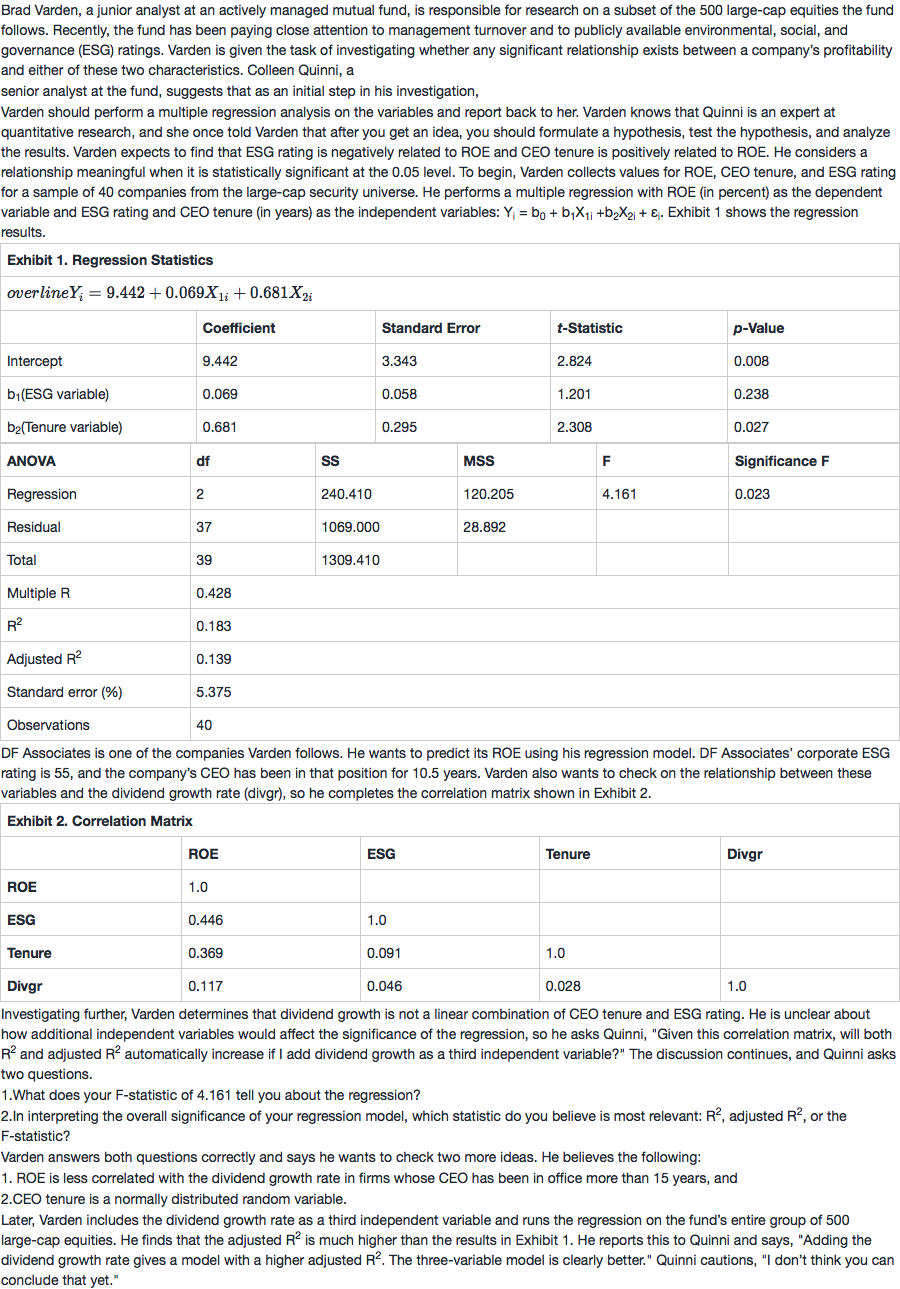

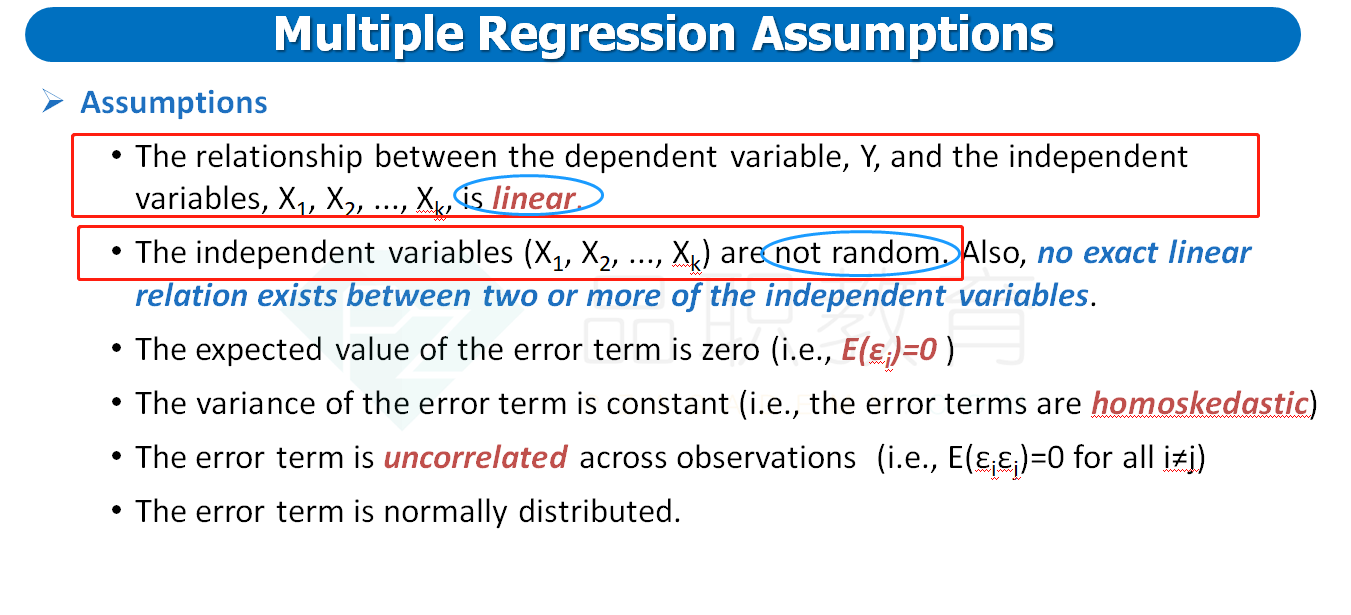

C is correct. Multiple linear regression assumes that the relationship between the dependent variable and each of the independent variables is linear.

Varden believes that this is not true for dividend growth because he believes the relationship may be different in firms with a long-standing CEO. Multiple linear regression also assumes that the independent variables are not random. Varden states that he believes CEO tenure is a random variable.

助教,能否解释一下这题的考点是什么么?以及为什么两个都违背了假设