NO.PZ2020010302000010

问题如下:

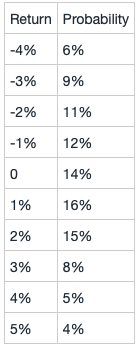

Suppose the return on an asset has the following distribution:

a. Compute the mean, variance, and standard deviation.

b. Verify your result in (a) by computing directly and using the alternative expression for the variance.

c. Is this distribution skewed?

d. Does this distribution have excess kurtosis? e. What is the median of this distribution?

选项:

解释:

a. The mean is E[X] = Σx Pr(X = x) = 0.25%.

The variance is .

The standard deviation is .

b. and so , which is the same.

c. The skewness requires computing

Thus the skewness is 0.021, and the distribution has a mild positive skew.

d. The kurtosis requires computing

Thus the kurtosis is 2.24. The excess kurtosis is then 2.24 - 3 = -0.76. This distribution does not have excess kurtosis.

e. The median is the value where at least 50% probability lies to the left, and at least 50% probability lies to the right. Cumulating the probabilities into a CDF, this occurs at the return value of 0%.

讲义40页中Var(aX)=a^2Var(X),遇见constant number a求Var是要平方的,可是为什么好几道题里面给prob(X)=a

E(X)=b,之后算Var的时候引入weights Prob(X)都没有平方而是直接乘以了weights呢?