NO.PZ2018101501000031

问题如下:

Company M has invested $20 million in fixed capital and another $5 million in working capital in a ten-year project. The equipment will be depreciated straight-line to zero over five years. It will generate additional annual revenues of $1.5 million and reduce annual cash operating expenses of $0.5 million. After ten years, the equipment will be sold for $3 million. The tax rate and the required rate of return are 25% and 10% respectively. However, after reappraising the project, the fixed capital investment will be adjusted downward by $2 million with no change in salvage value. What will happen on the project NPV?

选项: It will increase $2.38 million.

It will decrease $1.62 million.

C.It will increase $1.62 million.

解释:

C is correct.

考点:Cash Flow Projections: Expansion Project

解析:固定资产投资下降$2 million,折旧会下降$0.4 million,相对应的depreciation tax saving会下降 0.25*($2 million/5) = $0.1 million

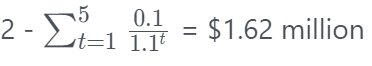

所以NPV最终会增加2 - = $1.62 million

老师你好,关于这题的符号方向,初始的固定资产的投资因为从20降到18,所以对于现金流来的变化来说是增加了2,后续因为初始固定的变化,OCF的计算中DT原来是4*25%=1,现在降级初始固定资产投资后DT是3.6*25%=0.9,对于OCF来说是减少了0.1,所以计算最后对NPV的影响就应该用

,因为已经考虑了方向了,所以最后NPV算出来是正数就应该选increase,请问老师以上的思路对不?