NO.PZ201809170400000203

问题如下:

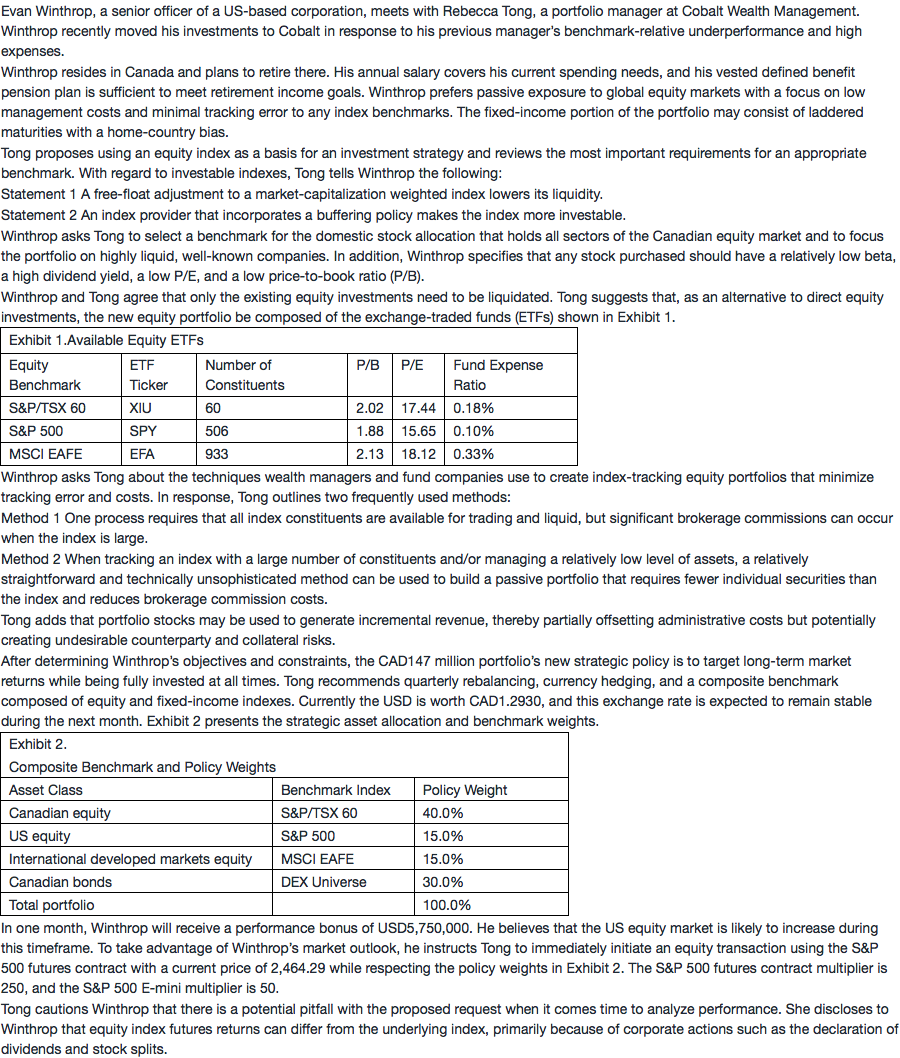

Based on Exhibit 1 and assuming a full-replication indexing approach, the tracking error is expected to be highest for:

选项:

A.

XIU.

B.

SPY.

C.

EFA.

解释:

C is correct. An index that contains a large number of constituents will tend to create higher tracking error than one with fewer constituents. Based on the number of constituents in the three indexes (S&P/TSX 60 has 60, S&P 500 has 506, and MSCI EAFE has 933), EFA (the MSCI EAFE ETF) is expected to have the highest tracking error. Higher expense ratios (XIU: 0.18%; SPY: 0.10%; and EFA: 0.33%) also contribute to lower excess returns and higher tracking error, which implies that EFA has the highest expected tracking error.

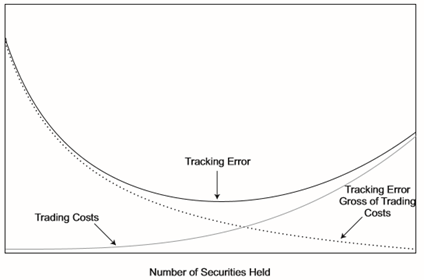

看了老师的解答可以归纳为以下两个角度嘛? 1.站在portfolio角度出发,股票数量越小,tracking error越大; 2.站在index角度,股票数量越多,越难被portfolio 复制,tracking error越大