NO.PZ201602060100001003

问题如下:

Based on Byron’s forecast, if NinMount deems it has acquired control of Boswell, NinMount’s consolidated 2019 depreciation and amortization expense (in £ millions) will be closest to:

选项:

A.

102.

B.

148.

C.

204.

解释:

C is correct.

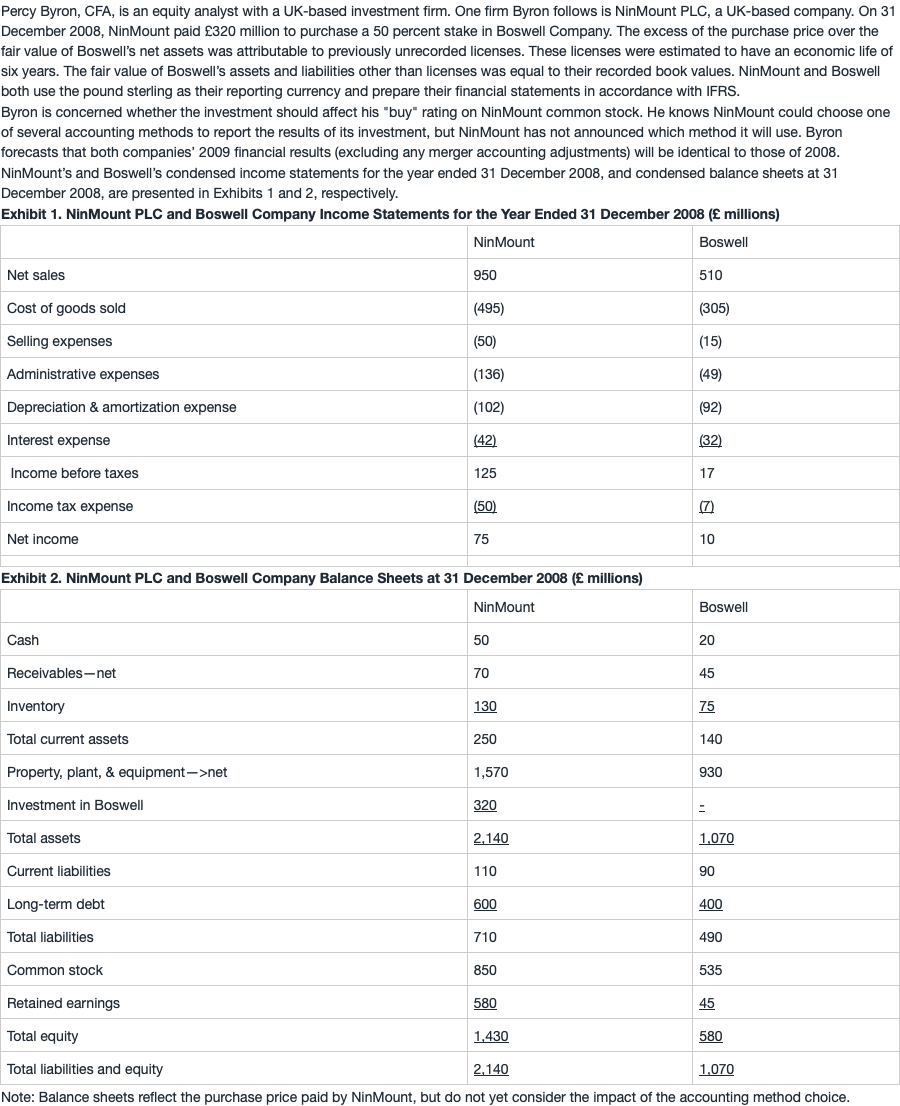

The projected depreciation and amortization expense will include NinMount’s reported depreciation and amortization (£102), Boswell’s reported depreciation and amortization (£92), and amortization of Boswell’s licenses (£10 million). The licenses have a fair value of £60 million. £320 purchase price indicates a fair value of £640 for the net assets of Boswell. The net book (fair) value of the recorded assets is £580. The previously unrecorded licenses have a fair value of £60 million. The licenses have a remaining life of six years; the amortization adjustment for 2018 will be £10 million. Therefore, Projected depreciation and amortization = £102 + £92 + £10 = £204 million.

考点 :合并报表(损益表)

解析 : 根据题干信息“acquired control”,应使用acquisition method,百分之百合并子公司资产、负债、损益表各项。

题干中说了 , 超出net fair value的部分是用于购买子公司的一个unrecorded licenses , 其他资产及负债的fair value=book value。这句话可以得到两个结论:

1. 子公司有一个未记账的资产,而在合并报表中,这项资产应该计入。它的价值是超过子公司净资产 fair value的部分,即=320/0.5 -580=60。

2. 该项合并不产生goodwill,因为超过子公司净资产FV的部分都是由于未记账的资产产生。(具体解释可以看第一问的解析)

该资产应该计入合并B/S中,那么加入资产之后也应该计提对应的折旧费用。目前因为没有入账,所以子公司现在的I/S中是没有包含这一项折旧的,所以在利润表中我们也需要做相应的调整。

unrecorded licenses 价值=60,6年折旧(题目条件),每年的折旧费用=10

所以合并报表之后 , 总的折旧和摊销=母公司折旧摊销+子公司折旧摊销+unrecorded licenses带来的调整项= £102 + £92 + £10 = £204 million.

我看答案中计算unrecorded liscense的方法是把Consideration (320mil)乘二 得到全部收购下的支付价再减去 100%的boswell FV of net identifiable assets,最终得到unrecorded liscense 的fv 60mil。 为什么如果我直接用支付的consideration (320 mil) 减去 50%的 Boswell FV of net identifiable assets (0.5*580 =290), 得到unrecorded liscense 的fv竟然是30mil。 我的理解是扩大50%或是缩小50%,只要前后相减的时候对应的单位对等的出来的结果应该是一样的呀?为什么会不一样呢。 请老师指点。