问题如下:

2. For Subscriber 2, and assuming all of the choices relate to the KRW/USD exchange rate, the best way to implement the trading strategy would be to:

选项:

A. write a straddle.

B. buy a put option.

C. use a long NDF position.

解释:

C is correct.

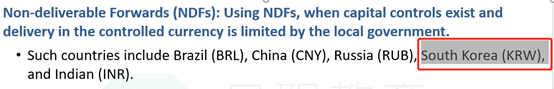

Based on predicted export trends, Subscriber 2 most likely expects the KRW/USD rate to appreciate (i.e., the won—the price currency—to depreciate relative to the USD). This would require a long forward position in a forward contract, but as a country with capital controls, a NDF would be used instead. (Note: While forward contracts offered by banks are generally an institutional product, not retail, the retail version of a non-deliverable forward contract is known as a -contract for differences- (CFD) and is available at several retail FX brokers.)

A is incorrect because Subscriber 2 expects the KRW/USD rate to appreciate. A short straddle position would be used when the direction of exchange rate movement is unknown and volatility is expected to remain low.

B is incorrect because a put option would profit from a depreciation of the KRW/USD rate, not an appreciation (as expected). Higher volatility would also make buying a put option more expensive.

解答说货币流通受限制,题目中哪句话表达了这个点?