NO.PZ2019010402000004

问题如下:

A manager holds a short position in an RMB/USD forward contract with remaining maturity of three months. At initiation, the forward rate is 7 RMB/USD. The current spot exchange rate is 7.3 RMB/USD, and the annually compounded risk-free rate is 5% for the RMB and 2% for the USD. The value of this position is:

选项:

A.

0.4985

B.

-0.3489

C.

0.3489

解释:

B is correct.

考点:currency forward 求value

解析:

这一题首先应该看清楚头寸是short position,对于currency的标价来说,头寸都是针对斜杠后面的货币,在这一题中,即卖USD,买RMB。

画图:

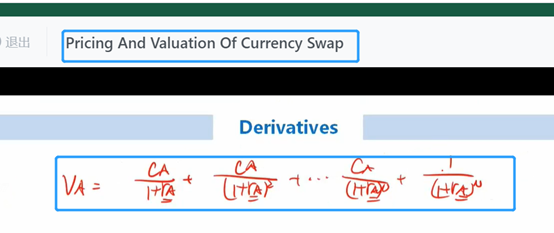

所以,