问题如下:

To best assess an ETF’s performance, which reflects the impact of portfolio rebalancing expenses and other fees, an investor should:

选项:

A. review daily return differences between the ETF and its benchmark.

B. perform a rolling return assessment between the ETF and its benchmark

C. compare the ETF’s annual expense ratio with that of other ETFs in its asset class category.

解释:

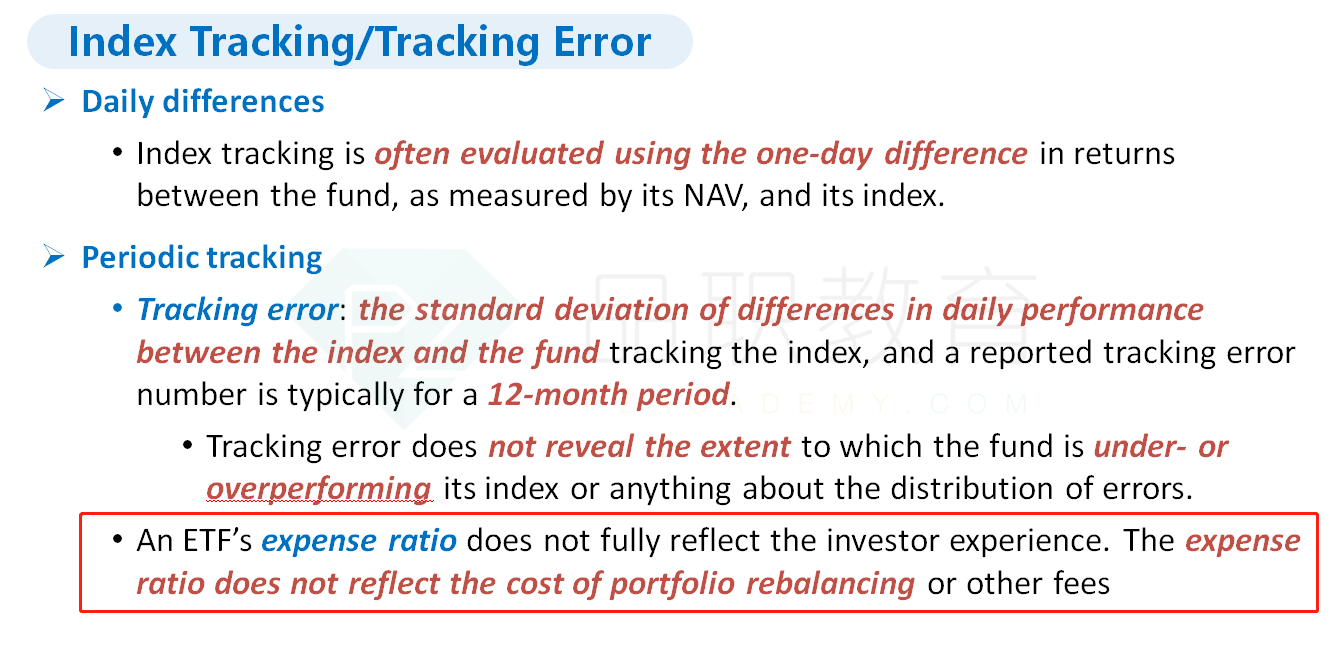

B is correct. A rolling return assessment, referred to in the ETF industry as the “tracking difference,” provides a more informative picture of the investment outcome for an investor in an ETF. Such an analysis allows investors to see the cumulative effect of portfolio management and expenses over an extended period. It also allows for comparison with other annual metrics such as a fund’s expense ratio. Tracking error, as a statistic, reveals only ETF tracking variability; it does not reveal to investors whether the fund is over- or underperforming its index or whether that tracking error is concentrated over a few days or is more consistently experienced. An ETF’s expense ratio does not fully reflect the investor experience. That is, the expense ratio does not reflect the cost of portfolio rebalancing or other fees, making it an inferior assessment measure relative to a rolling return assessment.

C是错在不是rolling计算而是写的annual来计算吗?