NO.PZ2018103102000112

问题如下:

Matt is forecasting FCFE for three companies by using the following equation: FCFE = NI – (1 – DR)(FCInv – Dep + WCInv). The relevant information of three companies is given in the following table. Which company is most likely inappropriate in using the equation?

选项:

A.Company B

B.Company C

C.Company A

解释:

A is correct.

考点:Special Issues: NCC Adjustments

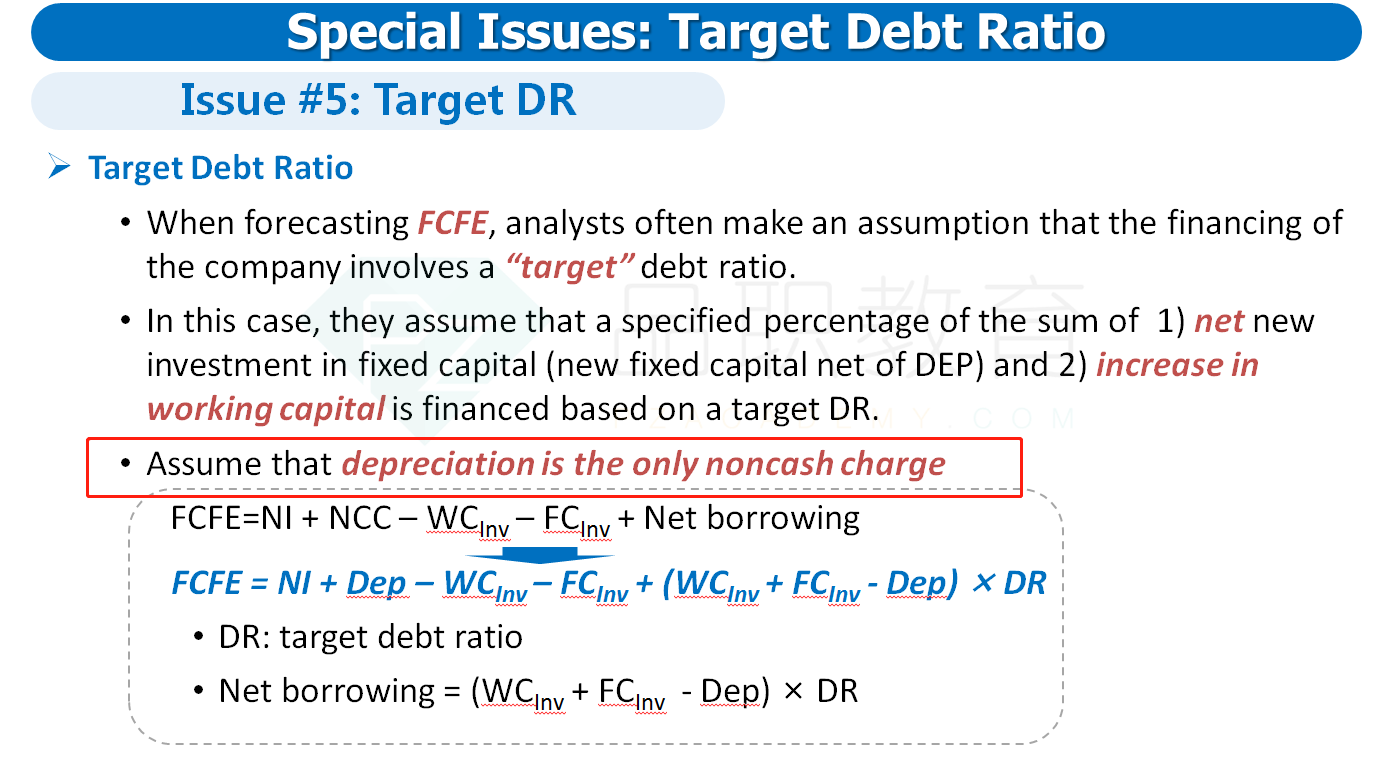

解析:题干中给出的计算FCFE的公式中只考虑了折旧这一项NCC,但是B公司相比其他两家公司有大量的除折旧外的NCC,所以B公司是最不适合用这个公式来计算FCFE的。

- 选的B公司主要由于新增了3000的LT Debt 理解为D/A ratio发生了重大改变 所以通过debt ratio算不一定适用 可以这么理解吗?

- 这道题的正确公式可以麻烦老师写一遍吗?我只记得DR*(WCinv+FCinv-Dep)