NO.PZ201812310200000203

问题如下:

Based on Kowalski’s assumptions and Exhibits 2 and 3, the credit spread on the VraiRive bond is closest to:

选项:

A.0.6949%.

0.9388%.

1.4082%.

解释:

C is correct. The credit spread can be calculated in three steps:

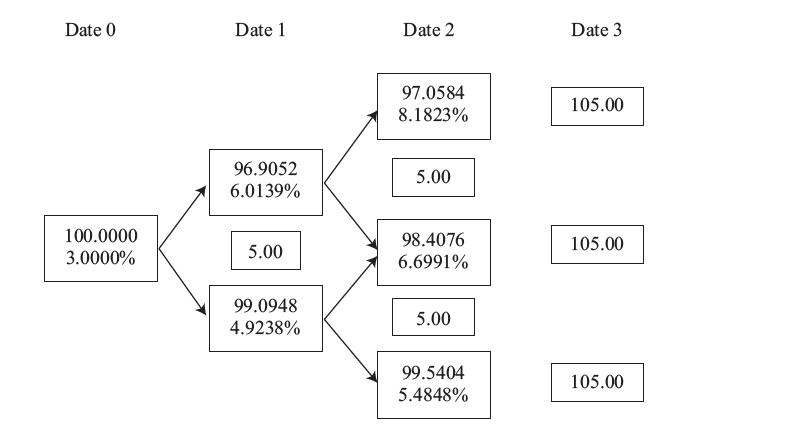

Step 1 Estimate the value of the three-year VraiRive bond assuming no default. Based on Kowalski’s assumptions and Exhibits 2 and 3, the value of the three-year VraiRive bond assuming no default is 100.0000.

Supporting calculations:

The bond value in each node is the value of next period’s cash flows discounted by the forward rate. For the three nodes on Date 2, the bond values are as follows:

105/1.081823 = 97.0584.

105/1.066991 = 98.4076.

105/1.054848 = 99.5404.

For the two nodes on Date 1, the two bond values are as follows:

[0.5 × (97.0584) + 0.5 × (98.4076) + 5.00]/1.060139 = 96.9052.

[0.5 × (98.4076) + 0.5 × (99.5404) + 5.00]/1.049238 = 99.0948.

Finally, for the node on Date 0, the bond value is

[0.5 × (96.9052) + 0.5 × (99.0948) + 5.00]/1.030000 = 100.0000.

Therefore, the VND for the VraiRive bond is 100.0000.

Step 2 Calculate the credit valuation adjustment (CVA), and then subtract the CVA from the VND from Step 1 to establish the fair value of the bond. The CVA equals the sum of the present values of each year’s expected loss and is calculated as follows:

Supporting calculations:

The expected exposures at each date are the bond values at each node, weighted by their risk-neutral probabilities, plus the coupon payment:

Date 1: 0.5 × (96.9052) + 0.5 × (99.0948) + 5.00 = 103.0000.

Date 2: 0.25 × (97.0584) + 0.5 × (98.4076) + 0.25 × (99.5404) + 5.00 = 103.3535.

Date 3: 105.0000

The loss given default (LGD) on each date is 2/3 of the expected exposure.

The probability of default (POD) on each date is as follows:

Date 1: 2%

Date 2: 2% × (100% – 2%) = 1.96%.

Date 3: 2% × (100% – 2%)2 = 1.9208%.

The discount factor on each date is 1/(1 + spot rate for the date) raised to the correct power.

Finally, the credit valuation adjustment each year is the product of the LGD times the POD times the discount factor, as shown in the last column of the table. The sum of the three annual CVAs is 3.7360.

So, the fair value of the VraiRive bond is the VND less the CVA, or VND – CVA = 100 – 3.7360 = 96.2640.

Step 3 Based on the fair value from Step 2, calculate the yield to maturity of the bond, and solve for the credit spread by subtracting the yield to maturity on the benchmark bond from the yield to maturity on the VraiRive bond. The credit spread is equal to the yield to maturity on the VraiRive bond minus the yield to maturity on the three-year benchmark bond (which is 5.0000%). Based on its fair value of 96.2640, the VraiRive bond’s yield to maturity (YTM) is 96.2640=5/(1+YTM)+5/(1+YTM)2+105/(1+YTM)3

Solving for YTM, the yield to maturity is 6.4082%. Therefore, the credit spread on the VraiRive bond is 6.4082% – 5.0000% = 1.4082%.

这里每一期的coupon rate分别是3%,4.2%,5%。为什么用二叉树算VND的时候,每一期的coupon都是5%来算的?

之前好像做过一道题,每一期的coupon也是要分别计算的。有点晕。