NO.PZ2018111501000009

问题如下:

Which of the following currency risk hedging strategy is the best description of discretionary hedging?

选项:

A.It is a rule-based approach that removes almost all discretion from the portfolio manager.

B.Portfolio manager has limited discretion on currency risk exposure, such as 5% deviation.

C.Its primary goal is to add alpha to the portfolio, not to reduce risk.

解释:

B is correct.

考点:四种不同的hedging strategy对比。

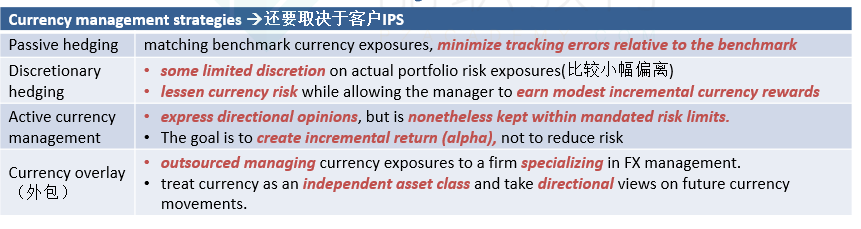

解析:共有四种currency risk hedging strategy:passive hedging, discretionary hedging, active currency management, currency overlay。其中,discretionary hedging允许基金经理有一些自己的观点,可以少量偏离基准,例如5%的偏离,B正确。它的目标是在减少currency risk基础上获得适当的currency return ,所以C错。A选项说的是passive hedging。

a选项整体的意思是?rule-base 如何理解?谢谢~~