NO.PZ2016091001000011

问题如下:

Assume that CC Inc. has $360,000 operating income in the early stages, and the operating income has changed as $420,000 later. The financial cost is $120,000. So the CC Inc.'s degree of financial leverage(DFL) is closest to :

选项:

A.1.3.

B.1.8.

C.1.5.

解释:

C is correct.

The operating income percentage change=$360,000$420,000−$360,000=16.67%

The net income percentage change=$360,000−$120,000($420,000−$120,000)−($360,000−$120,000)=25%

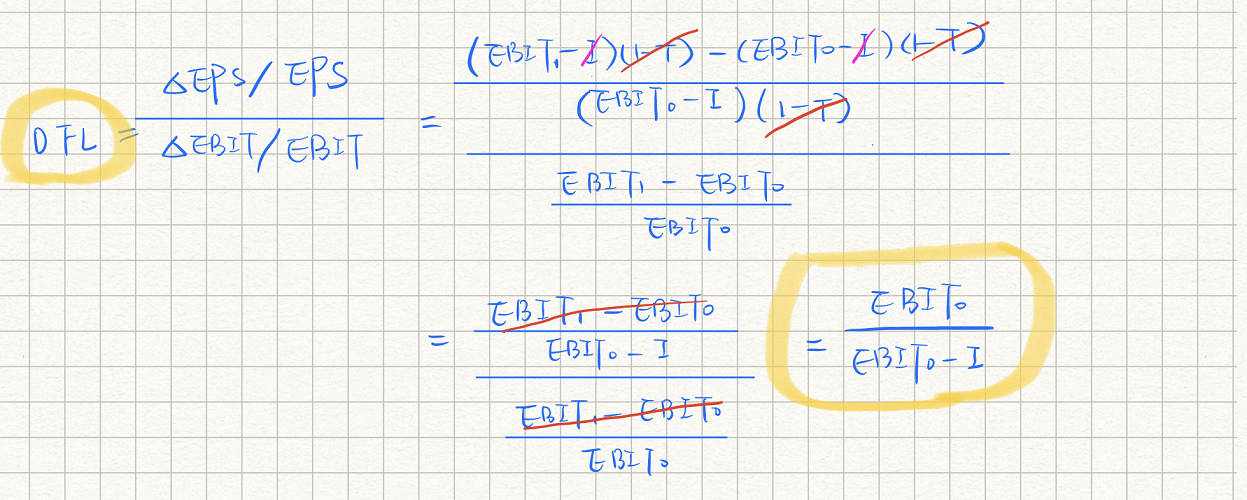

DFL =TheoperatingincomepercentagechangeThenetincomepercentagechange=16.67%25%=1.5

我直接用的EBIT/EBIT-Interest的公式 带入的是 360000/360000-120000 同样得到了1.5