NO.PZ2019012201000065

问题如下:

Based on Exhibit 2, theportion of total portfolio risk that is explained by the market factor in Fund1’s existing portfolio is closest to:

选项:

A. 3%

B. 81%

C. 87%

解释:

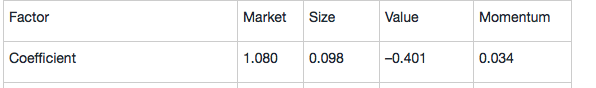

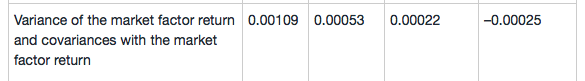

The portion oftotal portfolio risk explained by the market factor is calculated in two steps.The first step is to calculate the contribution of the market factor to totalportfolio variance as follows:

Where

CVmarket factor = contribution of the market factor to totalportfolio variance

xmarket factor = weight of the market factor in theportfolio

xj = weight of factor j in the portfolio

Cmf,j = covariance between the market factor and factor j

The variance attributed to the market factor is as follows:

CVmarket factor = (1.080 × 0.00109 × 1.080) + (1.080 ×0.00053 × 0.098) + (1.080 × 0.00022 × –0.401) + (1.080 × –0.00025 × 0.034)

CVmarket factor = 0.001223

The second step isto divide the resulting variance attributed to the market factor by theportfolio variance of returns, which is the square of the standard deviation ofreturns:

Portion of totalportfolio risk explained by the market factor = 0.001223/(0.0374)2

Portion of totalportfolio risk explained by the market factor = 87%

请问表格第三行variance of the market factor return and covariance with the market factor return是什么意思?这道题用李老师的九宫格法不知道该怎么解,表格中哪个代表权重,哪个代表风险?