Philippe Zachary is 50 years old and resides in France. He is working with his wealth manager, Pierre Robé, to develop an estate planning strategy to transfer wealth to his second cousin, Etienne.

Annual exclusions allow Zachary to make tax-free gifts of €20,000 per year, and gratuitous transfer tax liabilities are the responsibility of the recipient. Zachary notes that the relevant tax rate for bequests from the estate is likely to be 60 percent. He notes further, however, that gifts (in excess of the €20,000 exception mentioned above) made prior to age 70 enjoy 50 percent relief of the normal estate tax of 60 percent. for an effective tax rate of 30 percent. In addition, Etienne enjoys a low tax rate of 20 percent on investment income because he has relatively low income. Zachary, on the other hand, is subject to a 48 percent tax rate on investment income. Zachary is considering gifting assets that are expected to earn a 6 percent real return annually over the next 20 years.

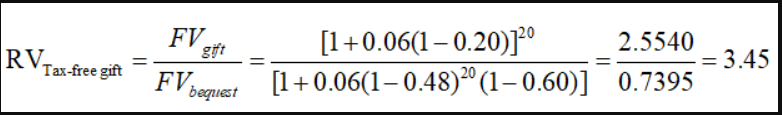

What is the relative value of the tax- free gift compared to the value of a bequest in 20 years?

请问计算gift的FV时,为什么不乘gift tax (1-0.3)

题干中这句不是说gift tax 减半时0.3的意思吗?gifts (in excess of the €20,000 exception mentioned above) made prior to age 70 enjoy 50 percent relief of the normal estate tax of 60 percent. for an effective tax rate of 30 percent.

哪里体现了gift免税