NO.PZ201710100100000403

问题如下:

3. Based on Exhibit 1, which fund is expected to produce the greatest consistency of active return?

选项:

A.Fund X

B.Fund Y

C.Fund Z

解释:

C is correct.

The IR measures the consistency of active return. The IR is calculated for the three funds as follows:

IR for Fund X = (10.0 – 9.4)/5.2 = 0.6/5.2 = 0.12

IR for Fund Y = (11.6 – 9.4)/9.2 = 2.2/9.2 = 0.24

IR for Fund Z = (13.2 – 9.4)/15.1 = 3.8/15.1 = 0.25

Fund Z has the largest IR and thus is expected to produce the greatest consistency of active return

考点:information ratio

解析:题干问的是 greatest consistency of active return持续的超额回报,也就是基金经理主动管理基金的能力,因为衡量指标为information ratio。通过计算,XYZ的IR分别为:0.12,0.24,0.25。因此选C。

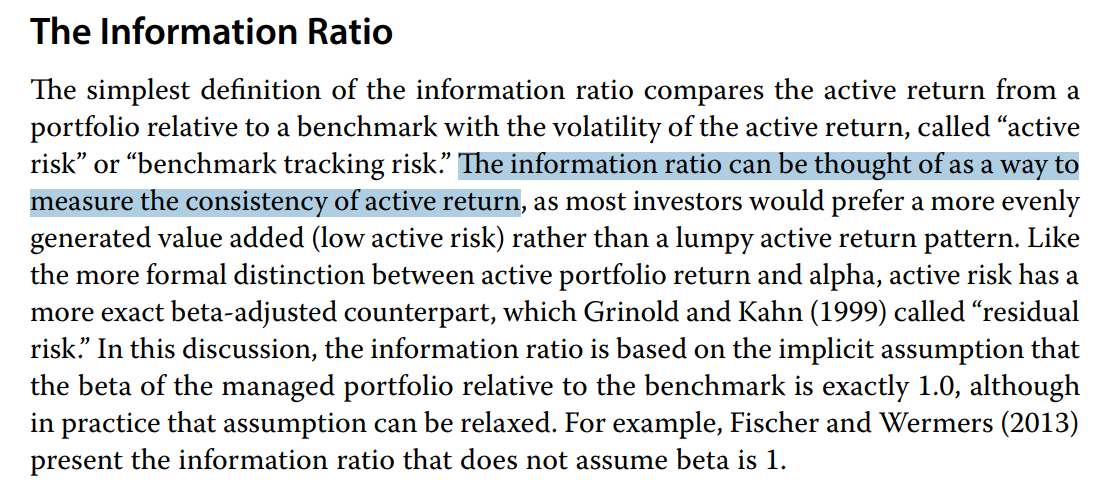

问题问的是greatest consistency,IR大只能说明单位风险获得的active return更多吧,这个和active return能不能持续没有关系?即IR大和return的持续性无关,即return大也不能说明这个return就能一直持续下去吧

如果volatility很大的话那说明波动大,则说明无法一直保持有active return,所以选volatility最小的?

感觉其实知道怎么算,但不知道题目到底想让你求什么