问题如下:

Which of the following statements about Macaulay duration is correct?

选项:

A. A bond’s coupon rate and Macaulay duration are positively related.

B. A bond’s Macaulay duration is inversely related to its yield-to-maturity.

C. The Macaulay duration of a zero-coupon bond is less than its time-to-maturity.

解释:

B is correct.

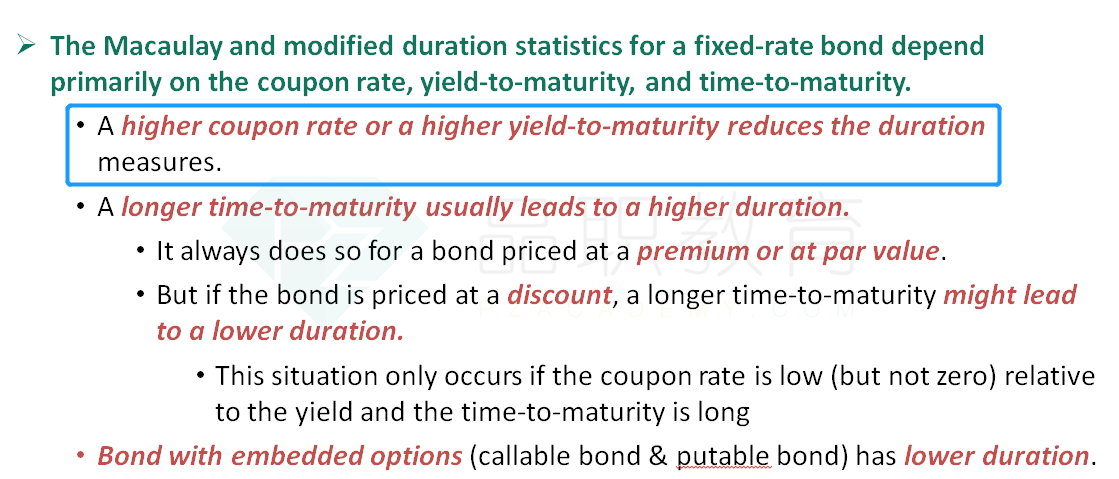

A bond’s yield-to-maturity is inversely related to its Macaulay duration: The higher the yield-to-maturity, the lower its Macaulay duration and the lower the interest rate risk. A higher yield-to-maturity decreases the weighted average of the times to the receipt of cash flow, and thus decreases the Macaulay duration.

A bond’s coupon rate is inversely related to its Macaulay duration: The lower the coupon, the greater the weight of the payment of principal at maturity. This results in a higher Macaulay duration. Zero-coupon bonds do not pay periodic coupon payments; therefore, the Macaulay duration of a zero-coupon bond is its time-to-maturity.

coupon rate变大,每期还的钱越多,应该是正相关啊