嗨,从没放弃的小努力你好:

同学你好,我先再把公式都列一下

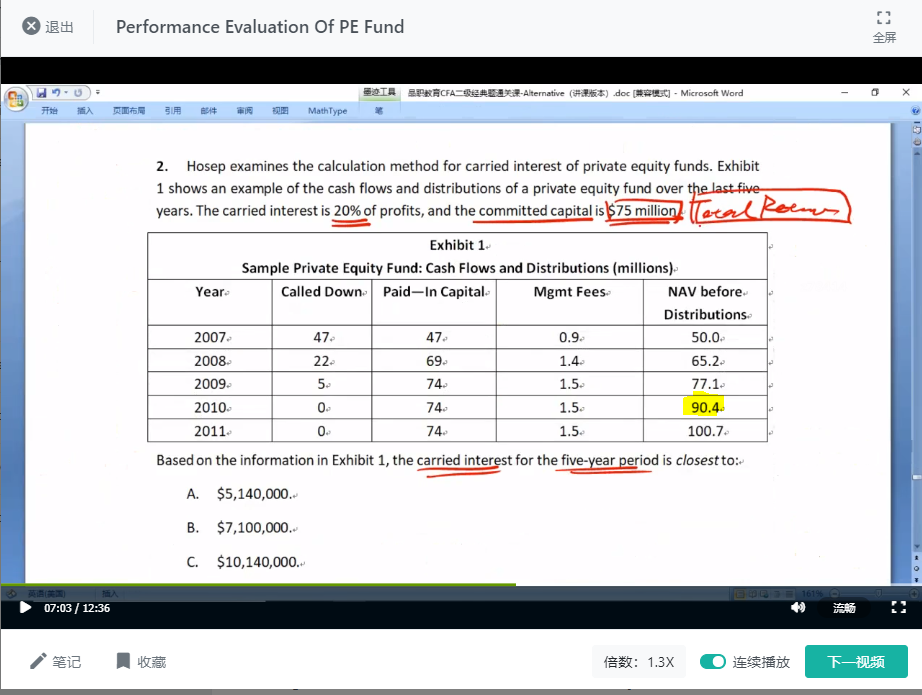

- Paid-in capital at T = Paid-in capital at T-1 + Capital called down in T

- Management fee at T = Paid-in capital in T * Management fee rate

- NAV before distribution at T = NAV after distribution at T-1 + Capital called down in T - Management fee at T + Operating results at T

- NAV after distribution at T = NAV before distribution at T – Carried interest in T – Distributions in T

核心还是要理解含义才能不用完全“背”公式

- Paid in capital是累积的call down,所以就是把call down每年加起来。

- mgmt fee是每年征收,那么就是PIC*mgmt fee %

- 核心就是这里 NAV before & after distribution.

- before是不考虑carreid interest和distribution的,而after就是在before基础上把这两部分减去。

然后几个比率:

DPI 为累计已分红金额(所有年份的distribution加和)/累计已投入资金(最后一年的paid-in capital),

RVPI 为还未分红部分(最后一年NAV after distribution)/累计已投入资金(最后一年paid-in capital),

两者之和为TVPI。

----------------------------------------------

加油吧,让我们一起遇见更好的自己!