NO.PZ2019052801000038

问题如下:

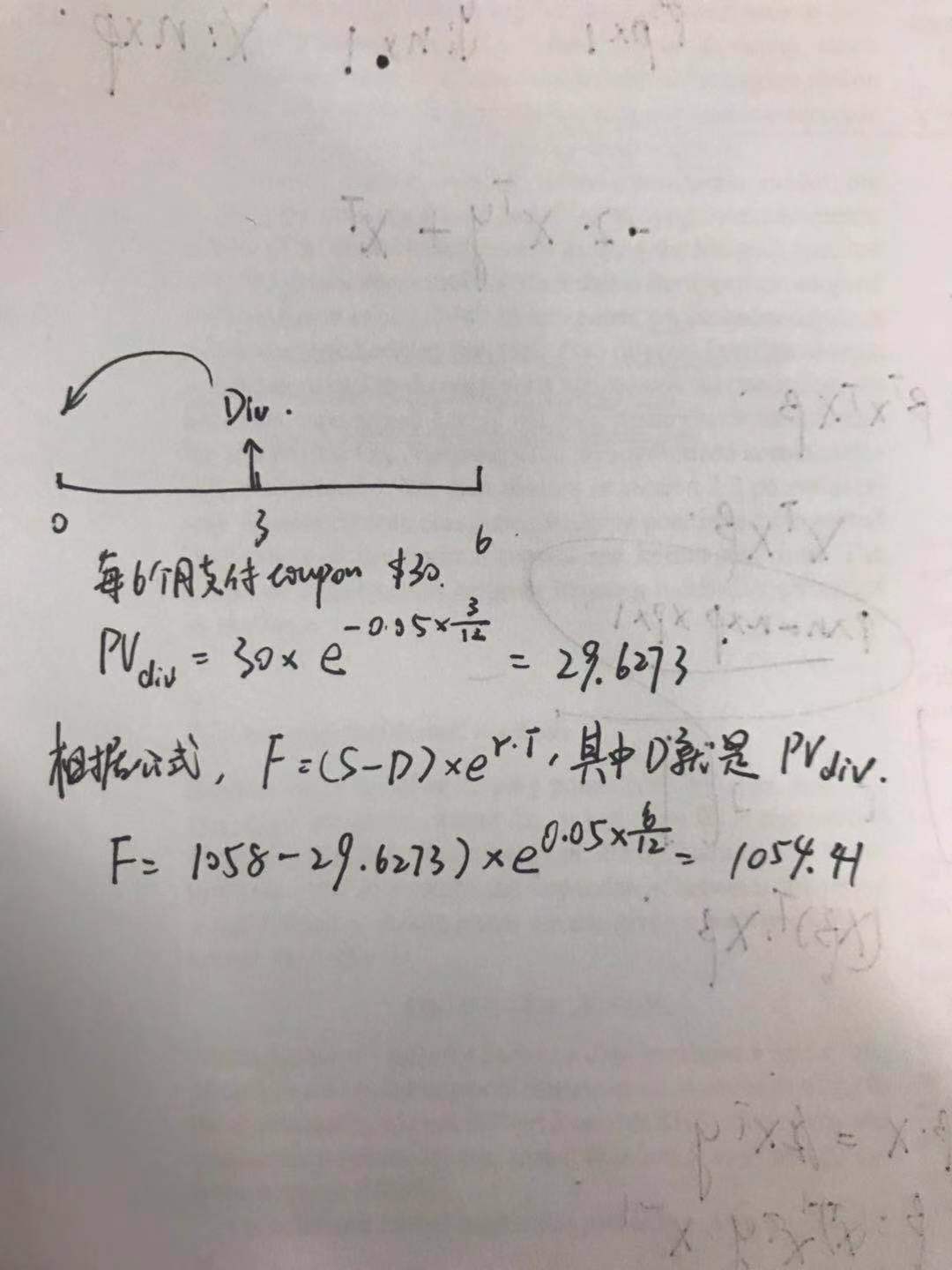

The price of a bond is $1,058, it has a coupon payment of $30 every six mouths, the last payment is three mouths ago. The continuous interest rate is 5%. Calculate the forward price of a 6-month forward contract on this bond:

选项:

A.$998.72.

B.$1,032.21.

C.$1,067.24.

D.$1054.41.

解释:

D is correct.

考点:远期合约定价

解析:

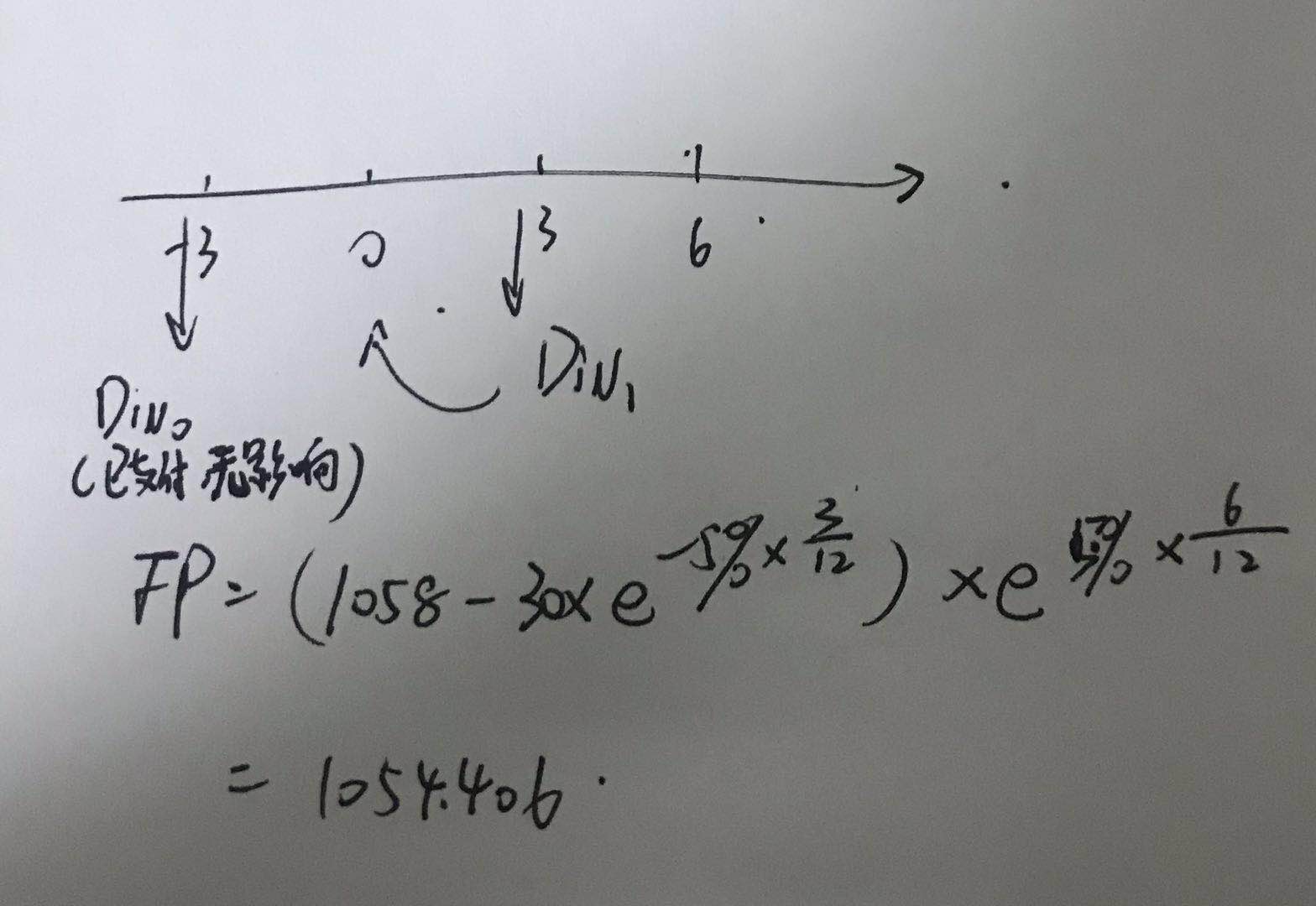

老师 麻烦可以画一下时间线吗 我不懂dividend是半年付一次,这里说的三个月前付的,我t时刻就是9个月,没明白

难道是上一笔dividend是t=-0.75的时候付的?