NO.PZ2016031001000104

问题如下:

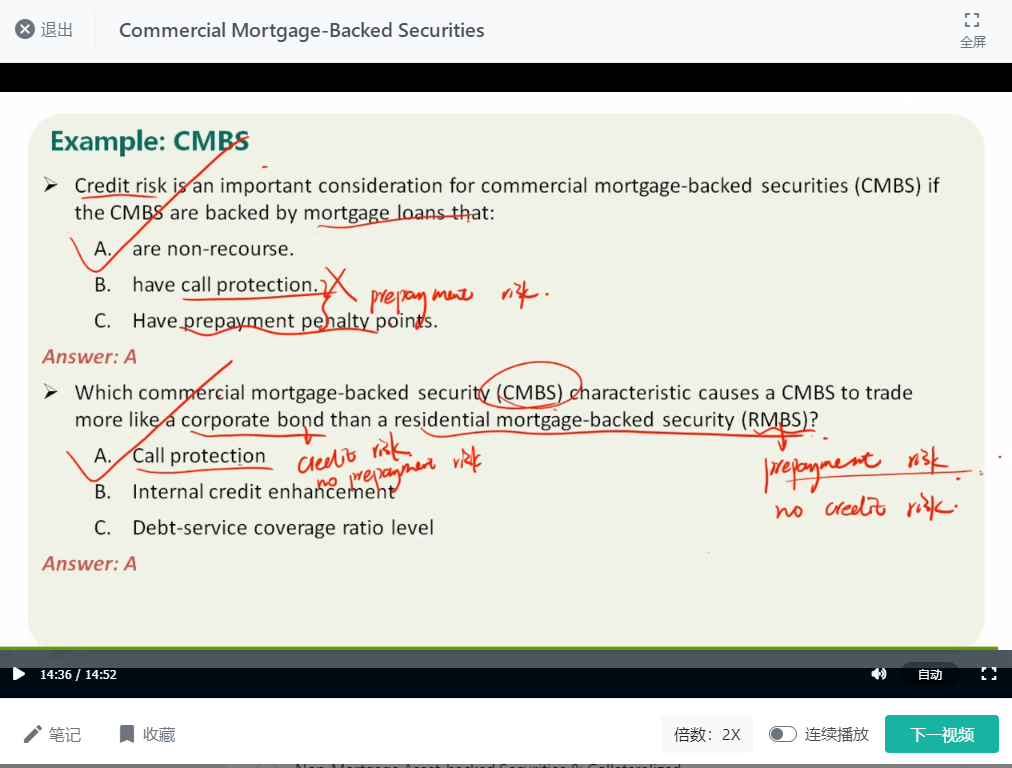

Which commercial mortgage-backed security (CMBS) characteristic causes a CMBS to trade more like a corporate bond than a residential mortgage-backed security (RMBS)?

选项:

A.Call protection

B.Internal credit enhancement

C.Debt-service coverage ratio level

解释:

A is correct.

With CMBS, investors have considerable call protection. An investor in a RMBS is exposed to considerable prepayment risk, but with CMBS, call protection is available to the investor at the structure and loan level. The call protection results in CMBS trading in the market more like a corporate bond than a RMBS. Both internal credit enhancement and the debt-service coverage (DSC) ratio address credit risk, not prepayment risk.

我的理解是CMBS和RMBS哪个更像公司债取决于两者的CF来源

RMBS来源于房贷 是borrower本身的现金流

CMBS基于property经营所得的CF 公司债也是基于公司经营所得的CF

所以选的C C里面提到了net operating income

这个想法为啥不对?题目也没明说到底是公司债的什么性质 这题感觉没说明白