NO.PZ2018091705000037

问题如下:

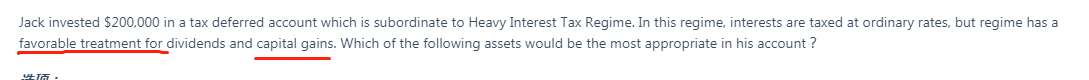

Jack invested $200,000 in a tax deferred account which is subordinate to Heavy Interest Tax Regime. In this regime, interests are taxed at ordinary rates, but regime has a favorable treatment for dividends and capital gains. Which of the following assets would be the most appropriate in his account?

选项:

A.Stocks with high capital gain

B.Bonds with high interest income

C.High dividend paying stocks.

解释:

B is correct.

考点:Seven global Tax regimes

解析:Heavy Interest Tax Regime,对于利息征重税,但是对于股息和资本利得有税收优惠。本题问的是放入tax deferred account中的资产最合适的是哪个?所以应该选高利息的债券,高利息的债券的税比较重,所以我们应该把他放在免税账户或者可以递延交税的账户。所以相对于其它两个,高利息的债券最适合放在这个TDA账户。

A要怎么排除呢