NO.PZ2018062003000208

问题如下:

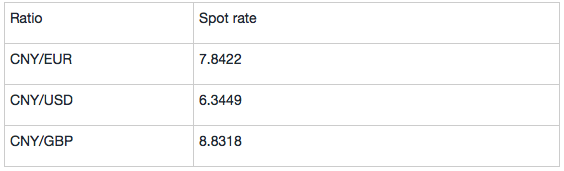

Nick and Joy are two dealers in America. A research report produced by Nick includes the following exhibit:

If Joy is quoting the USD/GBP cross-rate at 1.4210. Which of the following options is most accurate of the arbitrage profit?

选项:

A.USD 32,000 per million GBP traded.

B.GBP 29,000 per million USD traded.

C.USD 29,000 per million GBP traded.

解释:

C is correct.

The USD/GBP cross-rate from Nick is (8.8318/6.3449) = 1.3920, which is lower than 1.4210 . To earn an arbitrage profit, a currency trader would buy GBP use 1.3920 and sell GBP use 1.4210, So the profit would be

GBP 1,000,000 × (1.4210 – 1.3920) = USD 29,000

考点: cross-rate

解析:

美元/英镑汇率为(8.8318/6.3449)= 1.3920,低于1.4210。为了获得套利利润,货币交易员会以1.3920的价格买进英镑,以1.4210卖出英镑,所以利润是

1000000英镑*(1.4210 - 1.3920)= 29000美元

The USD/GBP cross-rate from Nick is (8.8318/6.3449) = 1.3920,没有理解 为什么用8.8318/6.3449,而不是反过来用6.3449/8.8318,请老师讲解下,没转过弯,谢谢