NO.PZ201902210100000101

问题如下:

Susan Winslow manages bond funds denominated in US Dollars, Euros, and British Pounds. Each fund invests in sovereign bonds and related derivatives. Each fund can invest a portion of its assets outside its base currency market with or without hedging the currency exposure, but to date Winslow has not utilized this capacity. She believes she can also hedge bonds into currencies other than a portfolio’s base currency when she expects doing so will add value. However, the legal department has not yet confirmed this interpretation. If the lawyers disagree, Winslow will be limited to either unhedged positions or hedging into each portfolio’s base currency.

Given the historically low rates available in the US, Euro, and UK markets, Winslow has decided to look for inter-market opportunities. With that in mind, she gathered observations about such trades from various sources. Winslow’s notes with respect to carry trades include these statements:

I. Carry trades may or may not involve a maturity mismatch. II. Carry trades require two yield curves with substantially different slopes. III. Inter-market carry trades just break even if both yield curves move to the forward rates.

Regarding inter-market trades in general her notes indicate: IV. Inter-market trades should be assessed based on currency-hedged returns. V. Anticipated changes in yield spreads are the primary driver of inter-market trades. VI. Whether a bond offers a relatively attractive return depends on both the portfolio’s base currency and the currency in which the bond is denominated.

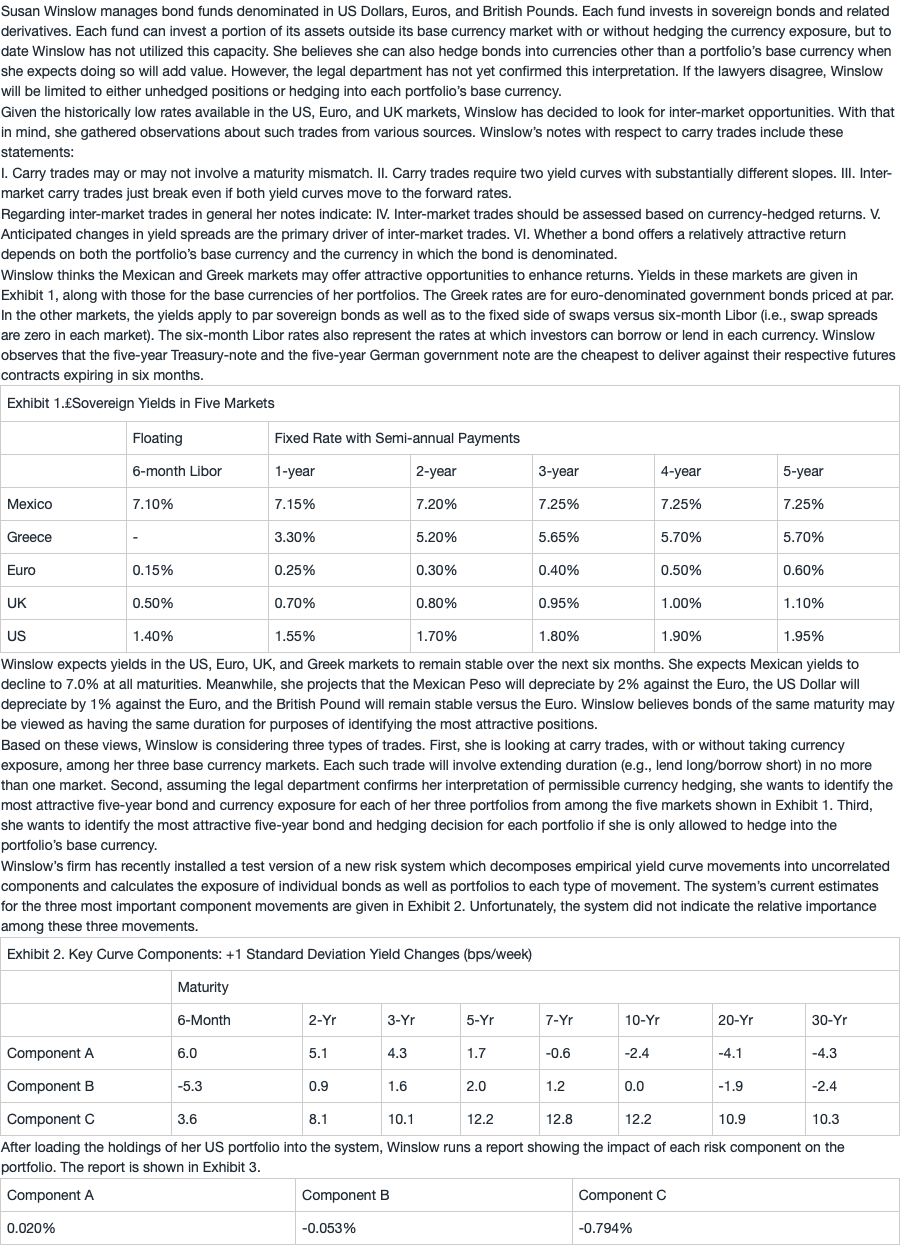

Winslow thinks the Mexican and Greek markets may offer attractive opportunities to enhance returns. Yields in these markets are given in Exhibit 1, along with those for the base currencies of her portfolios. The Greek rates are for euro-denominated government bonds priced at par. In the other markets, the yields apply to par sovereign bonds as well as to the fixed side of swaps versus six-month Libor (i.e., swap spreads are zero in each market). The six-month Libor rates also represent the rates at which investors can borrow or lend in each currency. Winslow observes that the five-year Treasury-note and the five-year German government note are the cheapest to deliver against their respective futures contracts expiring in six months.

Winslow expects yields in the US, Euro, UK, and Greek markets to remain stable over the next six months. She expects Mexican yields to decline to 7.0% at all maturities. Meanwhile, she projects that the Mexican Peso will depreciate by 2% against the Euro, the US Dollar will depreciate by 1% against the Euro, and the British Pound will remain stable versus the Euro. Winslow believes bonds of the same maturity may be viewed as having the same duration for purposes of identifying the most attractive positions.

Based on these views, Winslow is considering three types of trades. First, she is looking at carry trades, with or without taking currency exposure, among her three base currency markets. Each such trade will involve extending duration (e.g., lend long/borrow short) in no more than one market. Second, assuming the legal department confirms her interpretation of permissible currency hedging, she wants to identify the most attractive five-year bond and currency exposure for each of her three portfolios from among the five markets shown in Exhibit 1. Third, she wants to identify the most attractive five-year bond and hedging decision for each portfolio if she is only allowed to hedge into the portfolio’s base currency.

Winslow’s firm has recently installed a test version of a new risk system which decomposes empirical yield curve movements into uncorrelated components and calculates the exposure of individual bonds as well as portfolios to each type of movement. The system’s current estimates for the three most important component movements are given in Exhibit 2. Unfortunately, the system did not indicate the relative importance among these three movements.

After loading the holdings of her US portfolio into the system, Winslow runs a report showing the impact of each risk component on the portfolio. The report is shown in Exhibit 3.

Which of Winslow’s statements about carry trades is correct?

选项:

A.Statement I

B.Statement II

C.Statement III

解释:

A is correct.

Carry trades may or may not involve maturity mis-matches. Intra-market carry trades typically do involve different maturities, but inter-market carry trades frequently do not, especially if the currency is not hedged.

B is incorrect. Carry trades may involve only one yield curve, as is the case for intra-market trades. In addition, if two curves are involved they need not have different slopes provided there is a difference in the level of yields between markets.

C is incorrect. Inter-market carry trades do not, in general, break even if each yield curve goes to its forward rates. Intra-market trades will break even if the curve goes to the forward rates because, by construction of the forward rates, all points on the curve will earn the "first-period" rate (that is, the rate for the holding period being considered). Inter-market trades need not break even unless the "first-period" rate is the same in the two markets. If the currency exposure is not hedged, then breaking even also requires that there be no change in the currency exchange rate.

关于intra market 答案解释: Intra-market trades will break even if the curve goes to the forward rates because, by construction of the forward rates, all points on the curve will earn the "first-period" rate (that is, the rate for the holding period being considered)

这个地方我不太懂,intra market 不就是借短期然后投长期吗,curve移动到forward rate会有什么影响,(或者说goes to forward rate到底是什么意思,是短期利率变得和长期利率一样吗)

关于inter market 答案解释:Inter-market trades need not break even unless the "first-period" rate is the same in the two markets. If the currency exposure is not hedged, then breaking even also requires that there be no change in the currency exchange rate.

我的理解是,根据Covered interest rate parity, 汇率根据利率的变化而变化,从而导致carry trade无收益。可是这里又说要使它break even,汇率不能有改变。Inter-market trades need not break even unless the "first-period" rate is the same in the two markets. 这句话我也没有太懂