NO.PZ2016031001000059

问题如下:

Which bond will most likely experience the smallest percent change in price if the market discount rates for all three bonds increase by 100 basis points?

选项:

A. Bond A

B. Bond B

C. Bond C

解释:

B is correct.

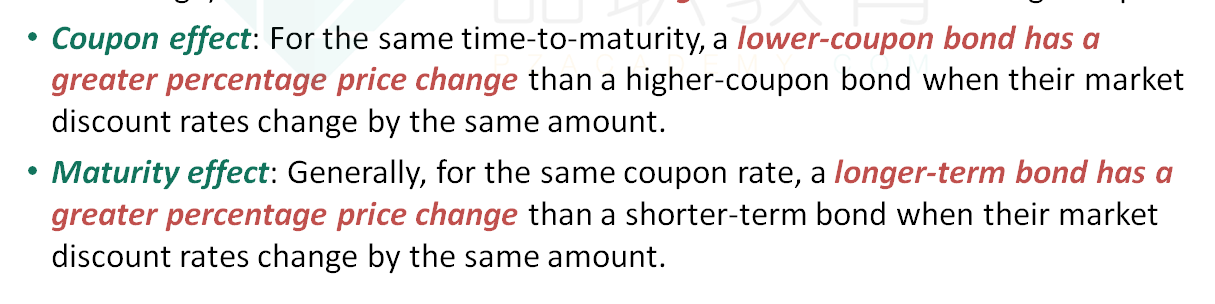

Bond B will most likely experience the smallest percent change in price if market discount rates increase by 100 basis points. A higher-coupon bond has a smaller percentage price change than a lower-coupon bond when their market discount rates change by the same amount (the coupon effect). Also, a shorter-term bond generally has a smaller percentage price change than a longer-term bond when their market discount rates change by the same amount (the maturity effect). Bond B will experience a smaller percent change in price than Bond A because of the coupon effect. Bond B will also experience a smaller percent change in price than Bond C because of the coupon effect and the maturity effect.

请问这个题目怎么求duration呢?计算器可以吗?还是要现金流一笔笔算Macaulay duration,再➗(1➕ytm)得到modified duration?