NO.PZ201712110100000208

问题如下:

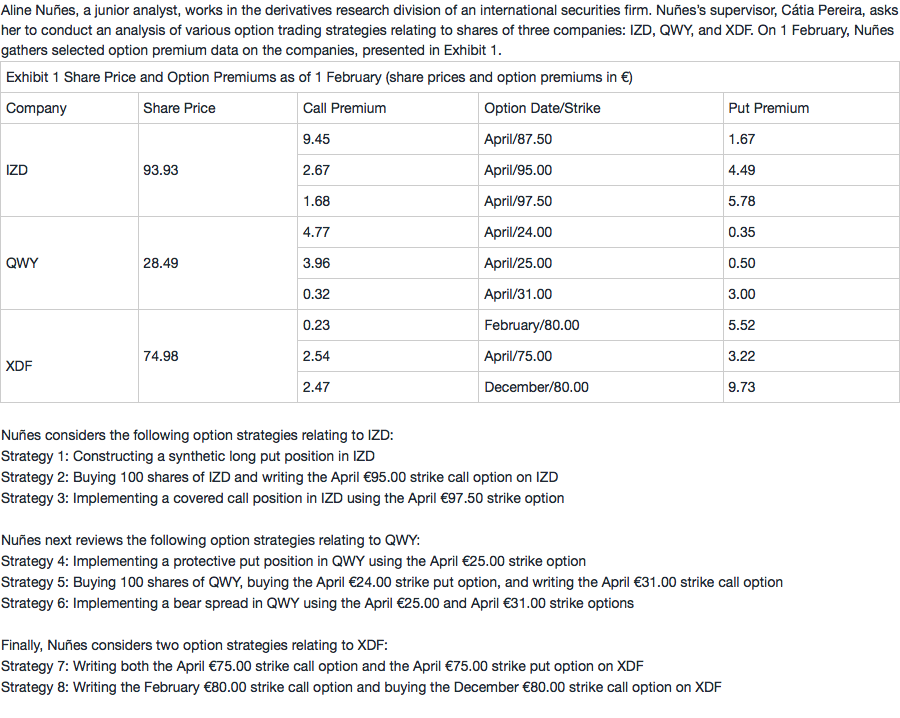

Based on Exhibit 1, the maximum gain per share that could be earned if Strategy 7 is implemented is:

选项:

A.€5.74.

€5.76.

unlimited.

解释:

B is correct.

Strategy 7 describes a short straddle, which is a combination of a short put option and a short call option, both with the same strike price. The maximum gain is €5.76 per share, which represents the sum of the two option premiums, or c0 + p0 = €2.54 + €3.22 = €5.76. The maximum gain per share is realized if both options expire worthless, which would happen if the share price of XDF at expiration is €75.00.

怎么看出来是short straddle的?而不是long呢?