NO.PZ2017092702000101

问题如下:

A client holding a £2,000,000 portfolio wants to withdraw £90,000 in one year without invading the principal. According to Roy’s safety-first criterion, which of the following portfolio allocations is optimal?

选项:

A.

Allocation A

B.

Allocation B

C.

Allocation C

解释:

B is correct.

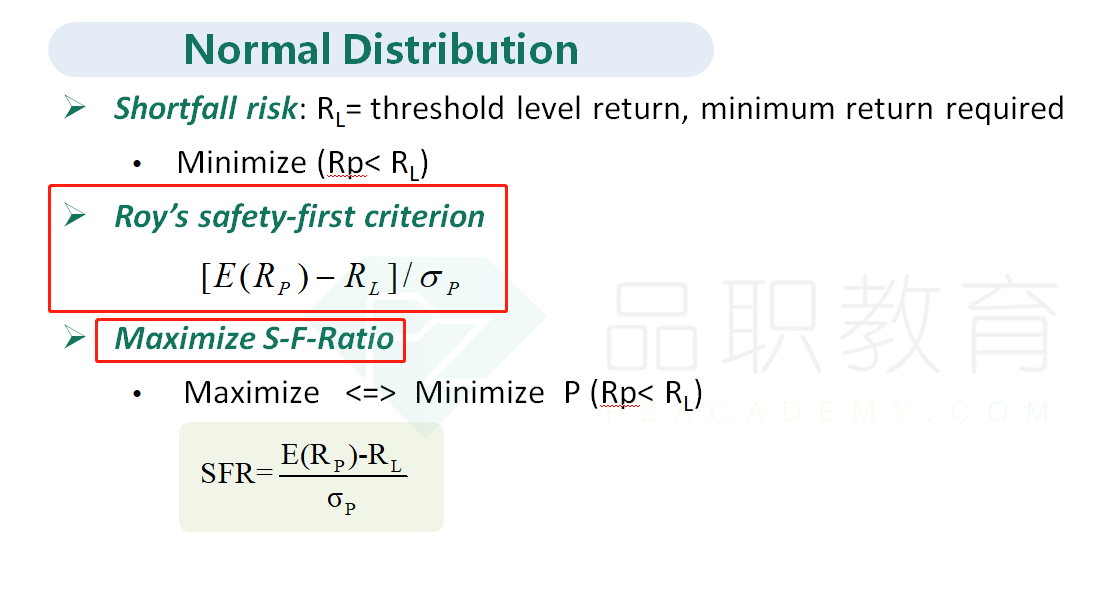

Allocation B has the highest safety-first ratio. The threshold return level RL for the portfolio is £90,000/£2,000,000 = 4.5%, thus any return less than RL = 4.5% will invade the portfolio principal. To compute the allocation that is safety-first optimal, select the alternative with the highest ratio: