NO.PZ201902210100000105

问题如下:

If Winslow is limited to unhedged positions or hedging into each portfolio’s base currency, she can obtain the highest expected returns by

选项:

A.buying the Mexican 5-year in each of the portfolios and hedging it into the base currency of the portfolio.

B.buying the Greek 5-year in each of the portfolios, hedging the currency in the GBP-based portfolio, and leaving the currency unhedged in the dollar-based portfolio.

C.buying the Greek 5-year in the Euro-denominated portfolio, buying the Mexican 5-year in the GBP and USD-denominated portfolios, and leaving the currency unhedged in each case.

解释:

B is correct.

Winston should buy the Greek 5-year bond for each portfolio. In the US dollar portfolio, she should leave the currency unhedged, accepting the exposure to the Euro, which is projected to appreciate by 1% against the USD. In the UK portfolio, she should hedge the bond’s EUR exposure into GBP. In the Euro-based portfolio there is no hedging decision to be made because the Greek bond is denominated in EUR.

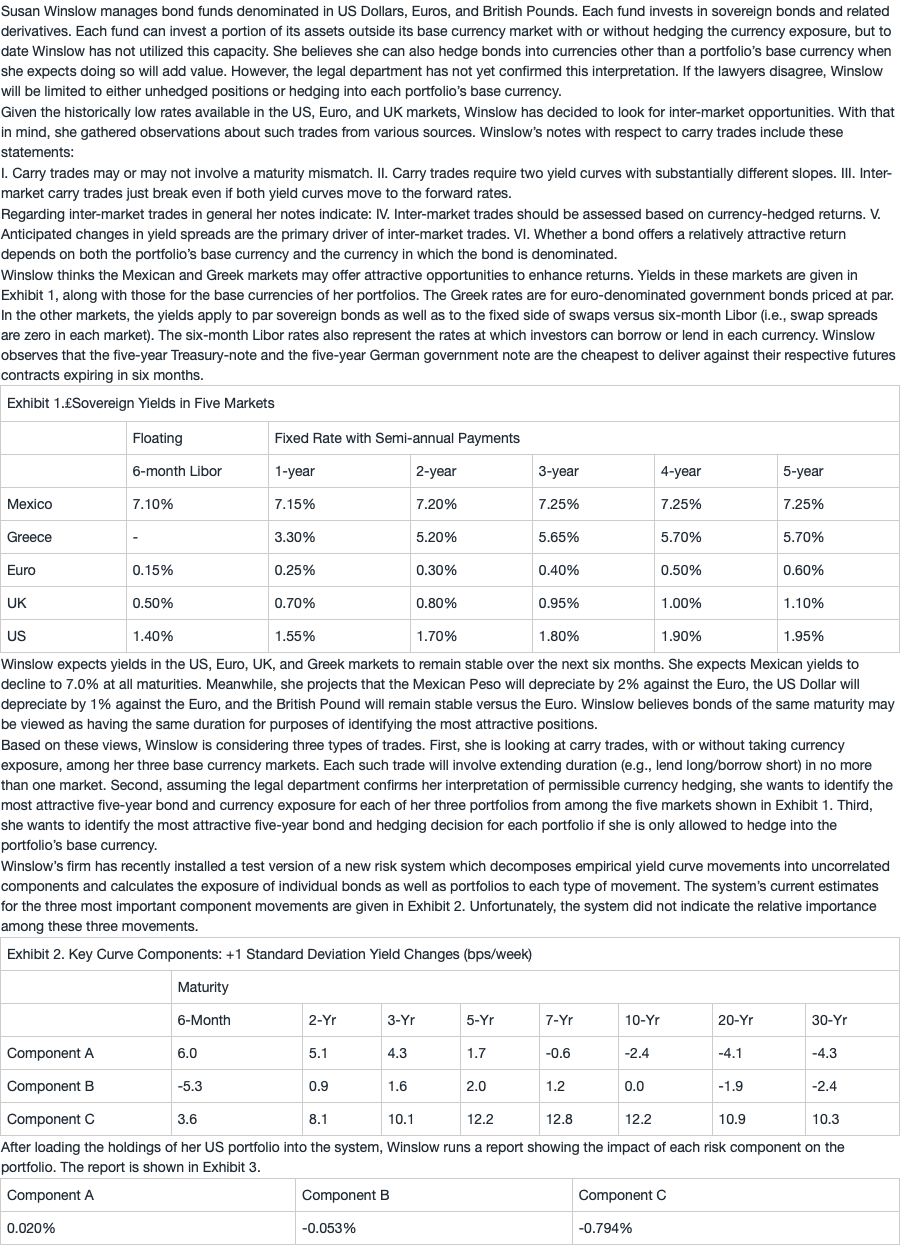

Because yields are projected to remain unchanged in the US, UK, Euro, and Greek markets, the 5-year Greek bonds will still be priced at par in six months and the US, UK, and Euro bonds will realize a negligible price appreciation when they have 4.5 years to maturity.

Hence, the local market return for each of these bonds will equal half of the coupon: 0.975%, 0.55%, 0.30%, and 2.85%, respectively. The Mexican 5-year will be priced to yield 7.0% at the end of the period. Its price will be

Its local market return is therefore 4.576% = (100.9501 + 7.25/2)/100. By covered interest parity, the cost of hedging a bond into a particular currency is the short-term (six months here) rate for the currency into which the bond is hedged minus the short-term rate for the currency in which the bond is denominated. For hedging US, UK, and Mexican bonds into Euros for six months the calculation is: USD into EUR: (0.15% – 1.40%)/2 = –0.625% GBP into EUR: (0.15% –0.50%)/2 = –0.175% MXN into EUR: (0.15% – 7.10%)/2 = –3.475%

(Note that a negative number is a cost while a positive number would be a benefit.)

Combining these hedging costs with each bond’s local market return, the returns hedged into EUR, which can now be validly compared, are: US: 0.975% + (–0.625%) = 0.350% UK: 0.550% + (–0.175%) = 0.375% MX: 4.576% + (–3.475%) = 1.101% GR: 2.850% + 0 = 2.850% EU: 0.300% + 0 = 0.300%

The Greek bond is by far the most attractive investment. This would still be true if returns were hedged into USD or GBP. So, the Greek 5-year should be purchased for each portfolio. Whether or not to actually hedge the currency exposure depends on if the cost/benefit of hedging is greater than the projected change in the spot exchange rate. For the dollar-denominated portfolio, hedging the Greek bond into USD would "pick up" 0.625% (the opposite of hedging USD into EUR). But EUR is expected to appreciate by 1.0% against the dollar, so it is better to leave the bond unhedged in the USD-denominated portfolio. Hedging EUR into GBP picks up 0.175% of return. Since EUR is projected to remain unchanged against GBP, it is better (from an expected return perspective) to hedge the Greek bond into GBP.

A is incorrect because it can be seen from the explanation for B above that the Greek 5-year bond is by far the most attractive investment, returning 2.85% compared to the Mexican 5-year bond’s return of 1.101%. If the returns for these bonds were hedged into USD or GBP (instead of EUR), in each case the return on the Mexican 5-year bond would still be inferior to that of the Greek 5-year bond.

C is incorrect because it can be seen from the explanation for B above that the Greek 5-year bond is by far the most attractive investment, returning 2.85% compared to the Mexican 5-year bond’s return of 1.101%. If the returns for these bonds were hedged into USD or GBP (instead of EUR), in each case the return on the Mexican 5-year bond would still be inferior to that of the Greek 5-year bond. Moreover, over the 6-month investment horizon the Mexican Peso is expected to depreciate against both the GBP and USD, further impairing the unhedged returns on the Mexican 5-year bond in GBP and USD terms.

base currency 和denominated currency的意思是base currency是基础货币,denominated currency是所买的外国债券吗

怎么讲denominated currency hedge成可比较的,这道题完全不明白