NO.PZ2019120301000004

问题如下:

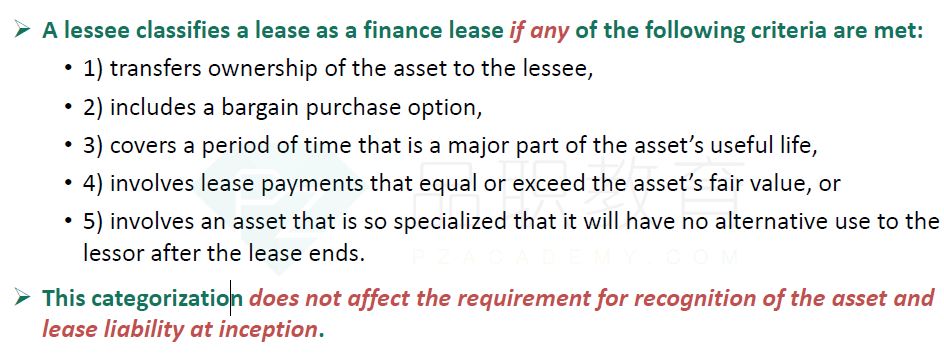

Under US GAAP, which of the following would least likely require the lessee to classify a lease as a capital lease?

选项:

A. The term covers a period of time that is a major part of the asset’s useful life.

B. The lease contains an option to purchase the asset at fair value.

C. The present value of the lease payments equals or exceeds the asset's fair value.

解释:

If the present value of the lease payments is equal to or greater than the fair value of the asset, the lease is considered a capital lease. A lease with a term that covers a major useful life of the asset is deemed to be a capital lease. The option to purchase the asset must be deemed to be cheap (bargain purchase option), not just include the option to purchase the asset.