NO.PZ2016082405000029

问题如下:

Which of the following statements best explains the relationship between CDS spreads and hazard rates?

选项:

A.Hazard rates are observable and can be used to infer credit spreads from backward induction.

B.Credit spreads are observable and can be used to infer hazard rates from backward induction.

C.Hazard rates are observable and can be used to infer credit spreads from bootstrapping.

D.Credit spreads are observable and can be used to infer hazard rates from bootstrapping.

解释:

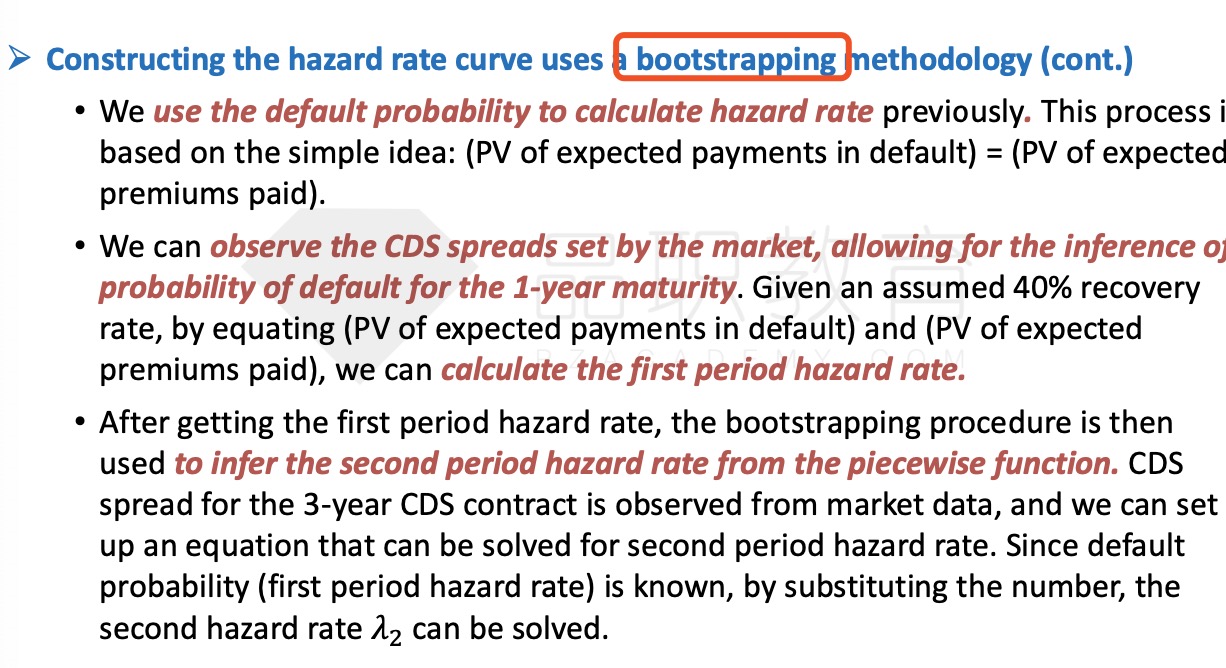

D Credit spreads are observable and, when used in conjunction with observed discount rates on swaps and the presumed recovery rate, the probability of default over the specific maturity can be inferred. The probability of default can, in turn, infer the hazard rate for the first period. Using the bootstrapped hazard rate from period l, the second period hazard rate can be inferred using the same procedure with observable data corresponding to the longer maturity.

已知 cds 求 hazard rate 不是用 hazard rate =CDS/(1-recovery rate)这个公式吗?和bootstrapping 有什么关系呢?