NO.PZ201710200100000203

问题如下:

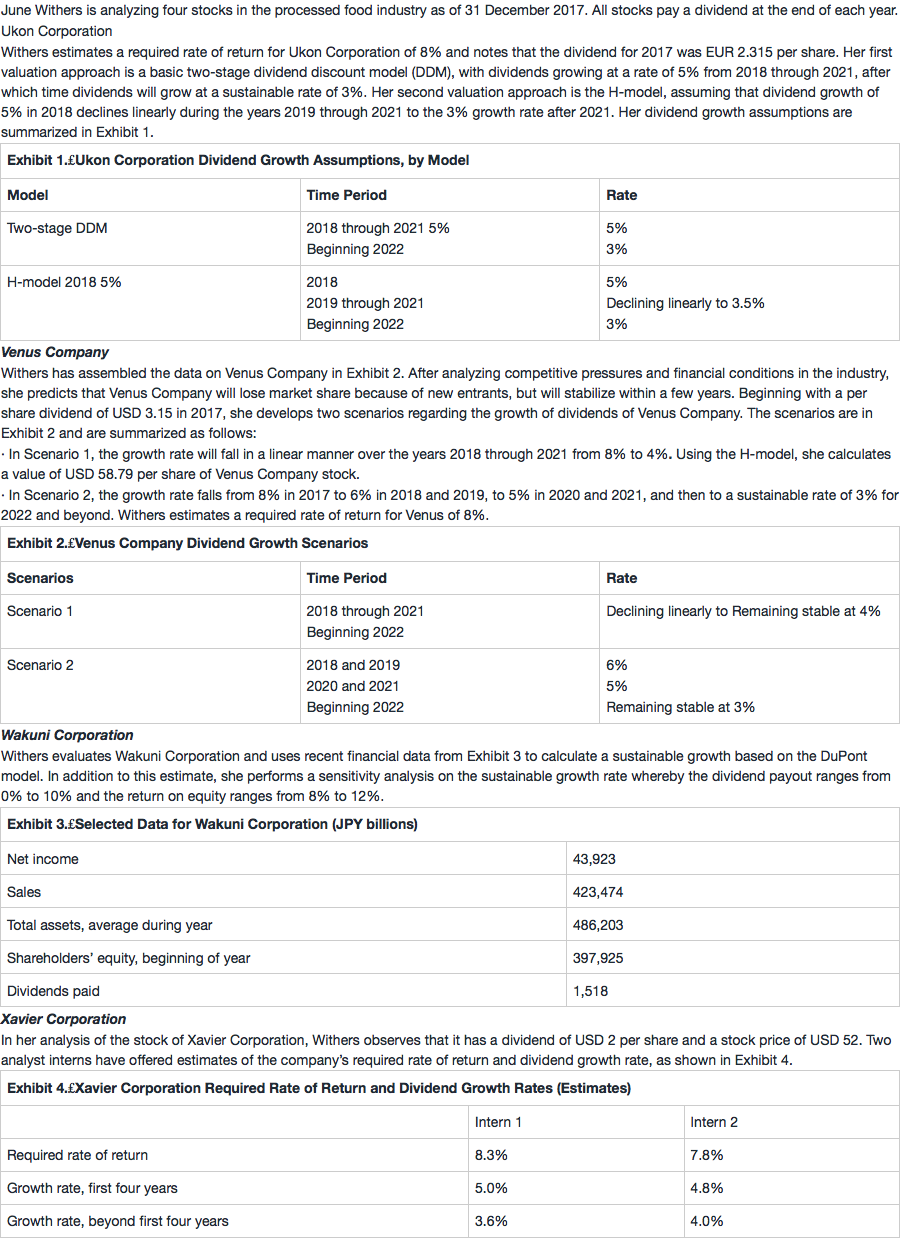

3. Using Withers’s assumptions for the H-model and the basic two-stage dividend discount model, the forecasted Ukon stock price at the end of the year 2021 for the H-model should be:

选项:

A.lower than the basic two-stage model.

B.the same as the basic two-stage model.

C.higher than the basic two-stage model

解释:

A is correct. During the first stage, the basic two-stage model has higher (i.e., 5%) growth than the H-model, in which growth is declining linearly from 5.0% to 3.5%. Higher growth rates result in higher forecasted dividends and stock prices at the beginning of the sustained growth phase. Because the long-term dividend growth rates are the same for both models, the difference in forecasted stock price arises from growth rate differences in the first stage.

Therefore, the dividend at the end of the first stage will be lower for the H-model than for the basic two-stage DDM, and the terminal value will be lower in the H-model than in the two-stage model. Specifically, the 2021 dividends will be

2.734 (i.e., 2.315 × 1.05 × 1.045 × 1.04 × 1.035) for the H-model versus 2.815 [i.e., 2.315 × (1.05)4] for the basic two-stage DDM.

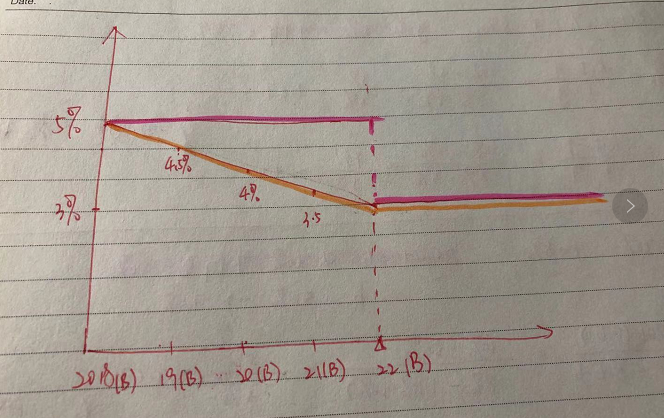

老师,我的思路是直接画图,Hmodel是三角形,而two stage是长方形,所以two stage面积大,这样可以吗