NO.PZ201710200100000409

问题如下:

9. The persistence factor suggested by Beckworth will lead to a multistage value estimate of TTCI’s shares that is:

选项:

A.less than Castovan’s multistage value estimate.

B.equal to Castovan’s multistage value estimate.

C.greater than Castovan’s multistage value estimate.

解释:

A is correct.

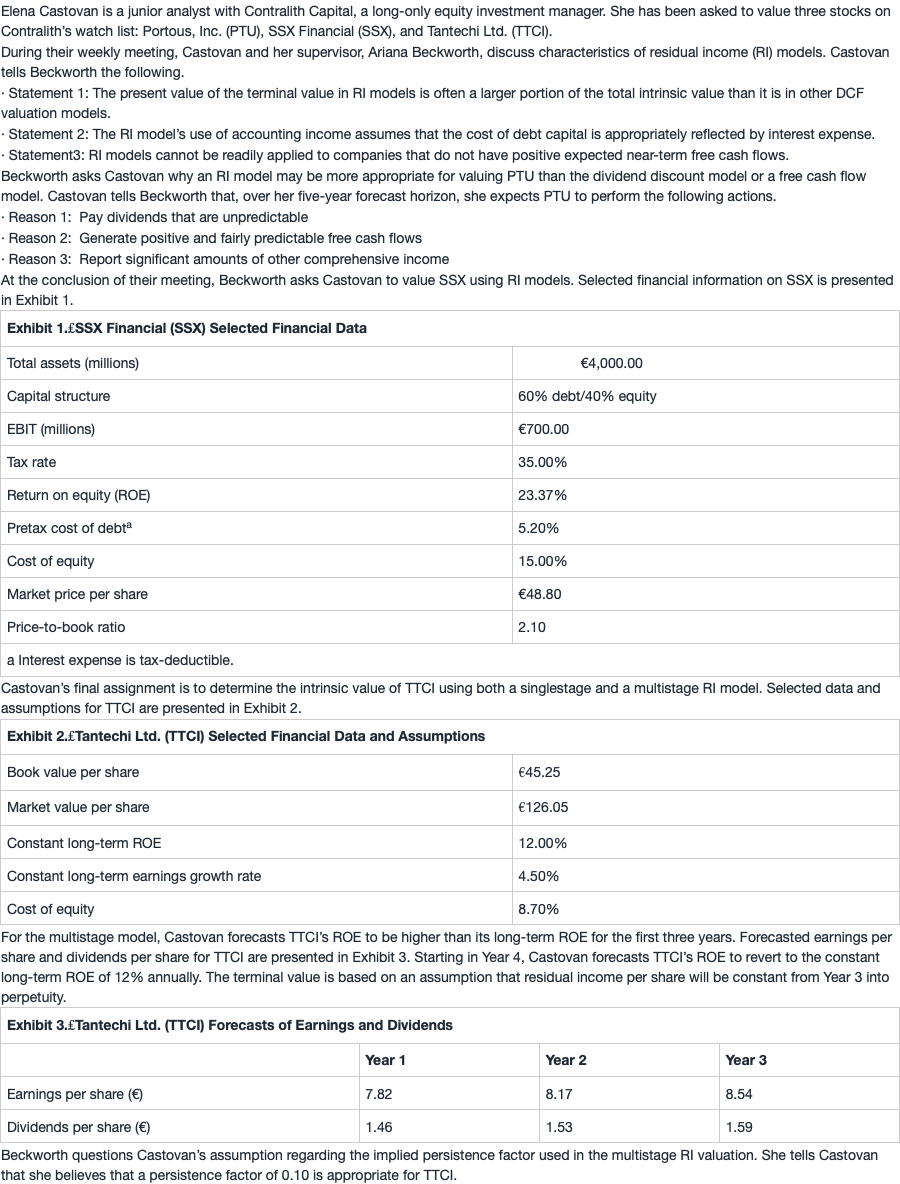

In Castovan’s multistage valuation, she assumes that TTCI’s residual income will remain constant in perpetuity after Year 3. This perpetuity assumption implies a persistence factor of 1 in the calculation of the terminal value. A persistence factor of 0.10 indicates that TTCI’s residual income is forecasted to decline at an average rate of 90% per year. This assumption would lead to a lower valuation than Castovan’s multistage value estimate, which assumes that residual income will remain constant in perpetuity after Year 3.

请问老师,

李老师上课画的图,w = 1未来 RI比 w降到很低时的RI高

可以这样理解吗?

谢谢!