NO.PZ2019010402000024

问题如下:

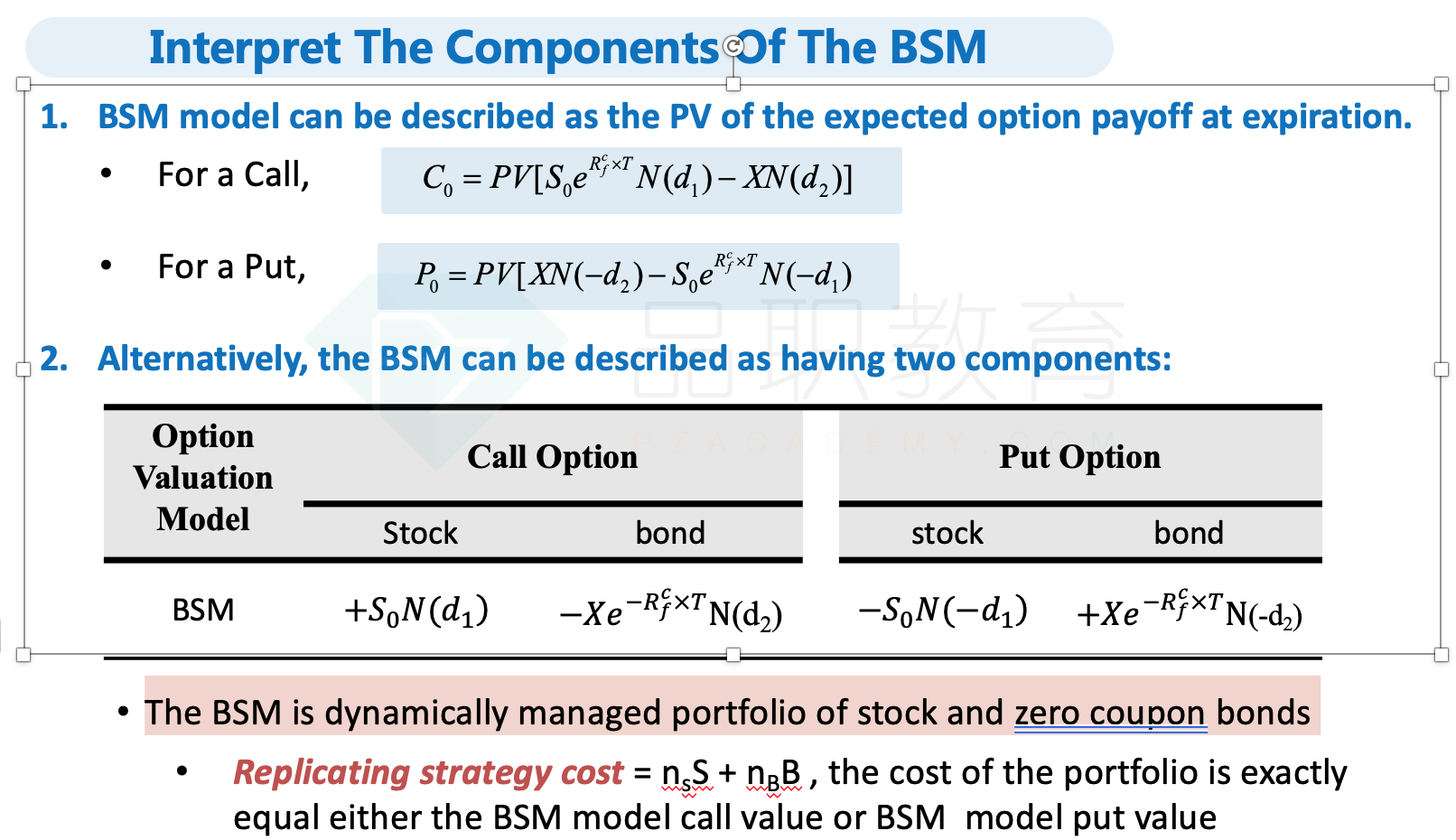

Stock of ABC is currently trading at $48.6. Suppose that volatility is 30% and the continuously compounded risk-free rate is 0.3%. Assume X=45, T=0.25, N(d1) =0.6352 and N(d2)=0.5486. Based on the BSM model, the replicating portfolio for the call can be constructed as:

选项:

A.long 0.6352 shares of ABC stock and short 0.5486 shares of a zero-coupon bond.

B.long 0.5486 shares of ABC stock and short 0.5486 shares of a zero-coupon bond.

C.long 0.6352 shares of ABC stock and short 0.4514 shares of a zero-coupon bond.

解释:

A is correct.

考点:BSM模型的解释

解析:

Call可以看成long N(d1)份的股票,short N(d2)份的零息债券,所以应该选A。

老师 请问BSM下是不是只能是0息债券