NO.PZ201812020100000705

问题如下:

Based on Exhibit 2, the amount that Hirji should allocate to the 2-year bond position is closest to:

选项:

A.C$331 million.

B.C$615 million.

C.C$1,492 million

解释:

C is correct.

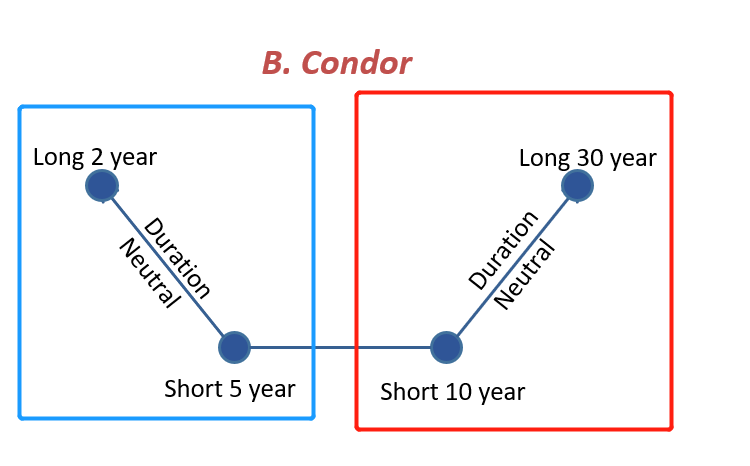

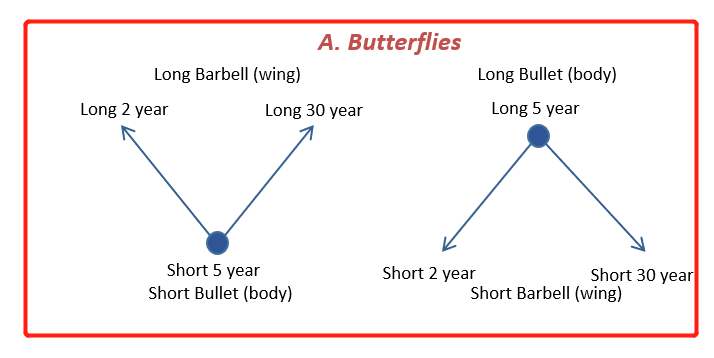

In order to take duration-neutral positions that will profit from an increase in the curvature of the yield curve, Hirji should structure a condor. This condor structure has the following positions: long the 2-year bonds, short the 5-year bonds, short the 10-year bonds, and long the long-term bonds. Hirji’s allocation to the 2-year bond position is calculated as follows: The C$150 million long-term bonds have a money duration of C$150 × 1,960 = C$294,000

Allocation to 2-year bond = Money duration of long-term bonds/PVBP of 2-year bond

2-year bond position = C$294,000/197 = 1,492.39 or C$1,492 million

老师我感觉这题出的不严谨啊,按理来说是中期的BPV(5年和10年的)=长短期的BPV(2年和长期的),即:2yr's BPV+long-term's BPV=5yr's BPV+10yr's BPV,这样子才对吧,并没有要求5yr's BPV=10yr's BPV和2yr's BPV=long-term's BPV的条件,只要左边翅膀和右边翅膀各自做到duration nuetral再加上上面的那个条件,这个condor的策略就不会出现倾斜的情况,所以这道题啥都没说,就要求2yr的MV,这不是太想当然了啊。。。。