NO.PZ201812020100000703

问题如下:

The answer to Prégent’s question is that the portfolio would most likely experience:

选项:

A.a loss.

B.no change.

C.a gain.

解释:

A is correct.

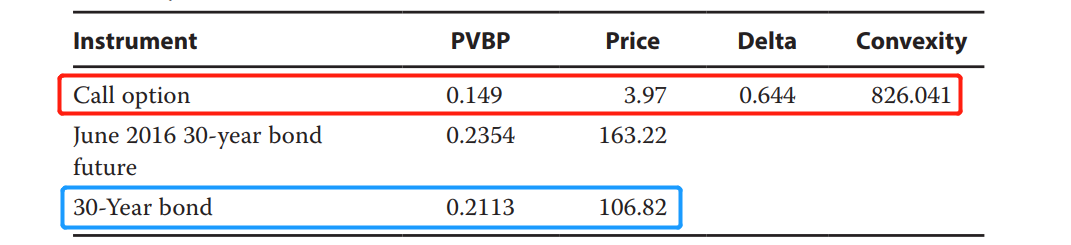

Short maturity at- or near-the-money options on long-term bond futures contain a great deal of convexity. Thus, options increase the convexity of the French client’s portfolio. Options are added in anticipation of a significant change in rates. If the yield curve remains stable, the portfolio will experience a loss from both the initial purchase price of the options and the foregone interest income on the liquidated bonds

老师如果sell long-term bond(不含权的),本身不就是在sell convexity吗?long term bond难道是没有option 属性的吗?只要是bond应该就有convexity的属性啊,卖长期的bond可以减少convexity啊。