NO.PZ201812020100000702

问题如下:

Based on Exhibit 1, the gain in convexity from Hirji’s suggestion is closest to:

选项:

A.0.423.

B.1.124.

C.1.205.

解释:

A is correct.

To maintain the effective duration match, the duration of the 10-year bond sale must equal the total weighted duration of the 3-year and long-term bond purchases.

9.51 = (Duration of 3-year bond × Weight of 3-year bond) + (Duration of long-term bond × Weight of long-term bond)

x = weight of 3-year bond

(1 – x) = weight of long-term bond

9.51 = 2.88x + 21.30(1 – x)

x = 0.64 or 64%

The proceeds from the sale of the 10-year Canadian government bond should be allocated 64% to the 3-year bond and 36% to the long-term bond:

9.51 = (64% × 2.88) + (36% × 21.30)

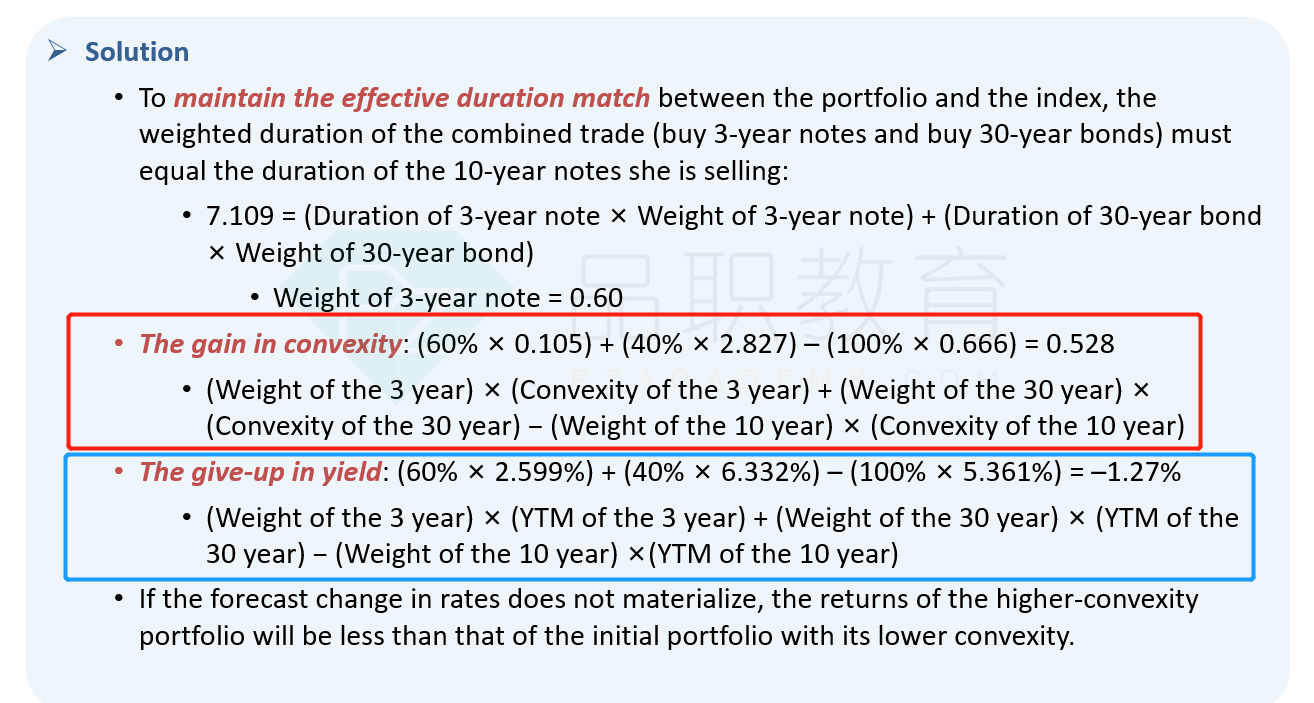

Gain in convexity = (Weight of the 3-year) × (Convexity of the 3-year) + (Weight of the long-term bond) × (Convexity of the long-term bond) – (Weight of the 10-year) × (Convexity of the 10-year)

Gain in convexity = (64% × 0.118) + (36% × 2.912) – (100% × 0.701) = 0.42284 or 0.423

这个题的问法容易让人产生误解啊,我会求36%和64%,这个我都想到了,但是他问gain from convexity,难道不是说spread的变化通过convexity的增加而带来的gain吗?我以为是total convexity=0.36*0.118+0.64*2.912=1.91,然后再用0.5*C*y^2,求出convexity部分的收益呢。。。感觉说的不严谨,get不到出题人的意思。。。