NO.PZ201712110200000408

问题如下:

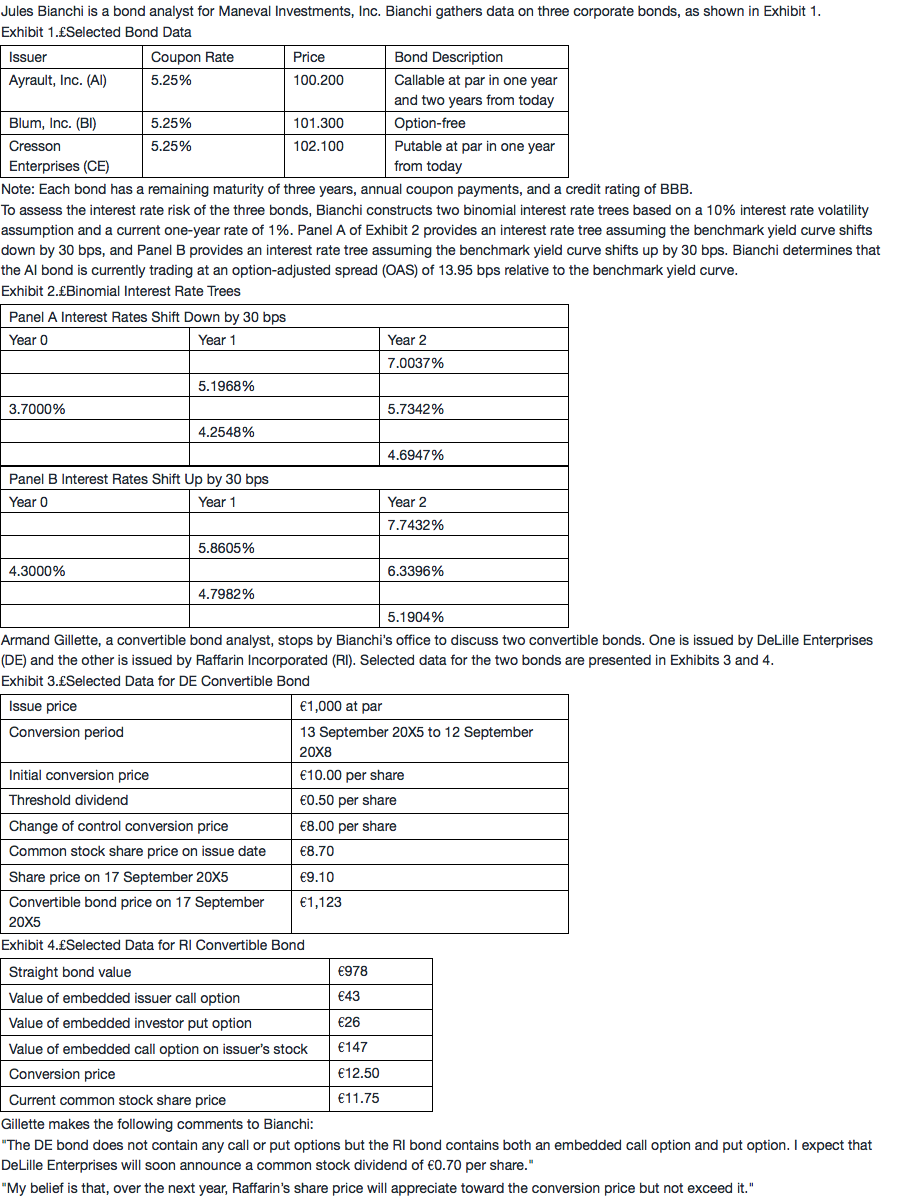

Based on Exhibit 4, the arbitrage-free value of the RI bond is closest to:

选项:

A.€814.

B.€1,056.

C.€1,108.

解释:

C is correct.

The value of a convertible bond with both an embedded call option and a put option can be determined using the following formula:

Value of callable putable convertible bond = Value of straight bond + Value of call option on the issuer’s stock – Value of issuer call option + Value of investor put option.

Value of callable putable bond = €978 + €147 – €43 + €26 = €1,108

还想继续问一下,那么在前面小题里(如下),为什么又要综合考虑 call 和put 的VALUE呢,怎么区分什么时候考虑什么时候不考虑呢。谢谢!

No.PZ201712110200000408

来源: 原版书

Based on Exhibit 4, the arbitrage-free value of the RI bond is closest to:

Value of callable putable convertible bond = Value of straight bond + Value of call option on the issuer’s stock – Value of issuer call option + Value of investor put option.