NO.PZ2018123101000086

问题如下:

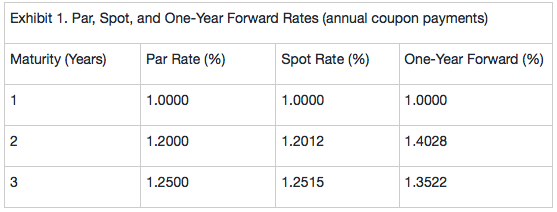

Exhibit 1 shows par, spot, and one-year forward rates.

Bond 4 is a fixed-Rate Bonds of Alpha Corporation, with 1.55% annual coupon and callable at par without any lockout periods. The bond maturity is 3 years.

Based on the information above, the value of the embedded option in Bond 4 is closest to:

选项:

A.nil.

B.0.1906.

C.0.3343.

解释:

C is correct.

考点:考察对含权债券的理解

解析:

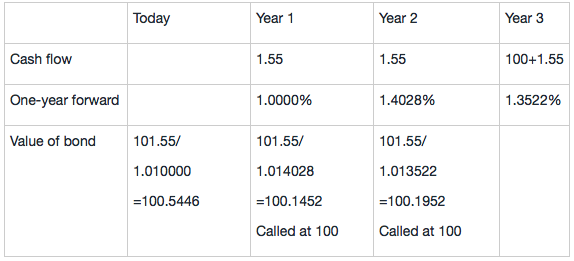

债券4是可Callable。其价值为:

Value of callable bond = value of straight bond – value of call option on bond

因此,Embedded call option的价值为:

Value of call option on bond = Value of straight bond – Value of callable bond

利用Spot rate对该Straight bond进行定价为:

而Callable bond的定价需要使用1-year forward rate,将债券的现金流从最后一期开始,依次向前一个节点折现,以判断折现值是否会触发行权价;使用表格中的Forward rate对Callable bond进行定价:

因此Call option的Value为:100.8789-100.5446=0.3343

用2-year forward rate或者3-month forward rate 不行吗