NO.PZ2020033001000073

问题如下:

Which of the following statements is an advantage of the CIR model?

选项:

A.During periods of high inflation, basis-point volatility decreases.

B.Interest rates are always non-negative.

C.Out-of-the money option prices may differ with the use of normal or lognormal distributions.

D.Long-run interest rates may not hover around a mean-reverting level.

解释:

B is correct.

考点:CIR model

解析:

A. Basis-point volatility increases during periods of high inflation.

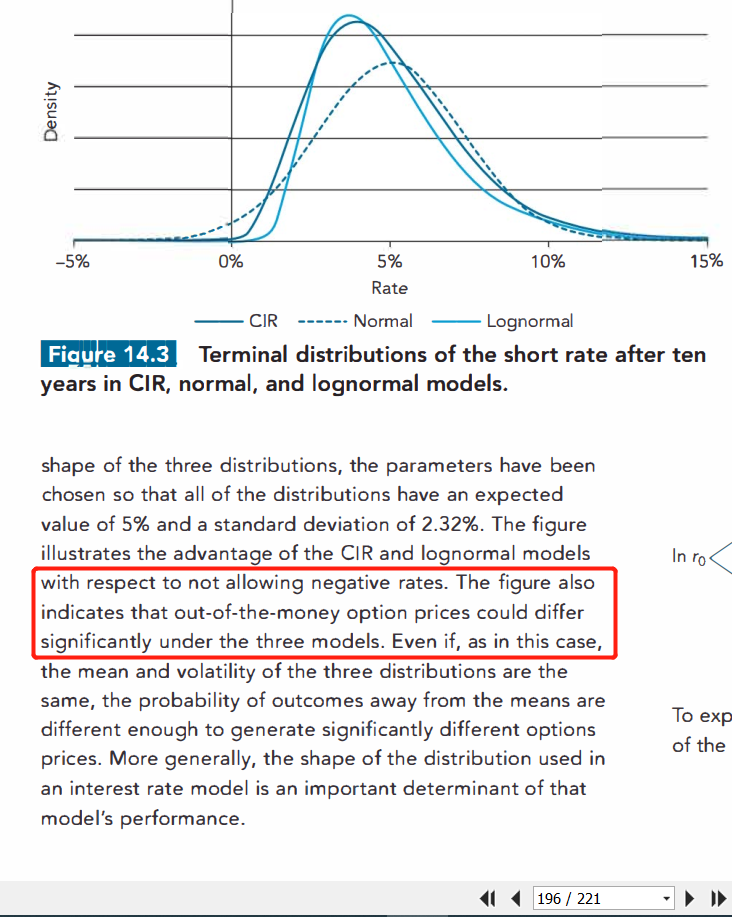

C. It is a disadvantage of CIR model.

D. CIR model is a mean-reverting model.

C是什么意思呢?