NO.PZ2018120301000048

问题如下:

Li, a fixed-income portfolio manager, believes that the yield curve will add more curvature in the 7-year to 10-year area. Li plans to build a duration-neutral condor strategy to benefit from this expectation. The positions used in the condor are shown below:

The maximum position allowed in the 15-year bond is 200 million and assumes that all positions in this condor strategy have the same money duration.

According to the information above, which short position is most likely in this condor strategy?

选项:

A.Short 424.24 million 7-year bond

B.Short 577.32 million 5-year bond

C.Short 22 million 10-year bond

解释:

A is correct.

考点:考察Condor strategy

解析:因为预测的是7年期到10年期这段期限的收益率相对其他期限的收益率上升,收益率曲线的曲度增加。同时构建一个Duration neutral的Condor策略,因此再此条件下增强收益的策略是Short 7年期、10年期的债券;同时买15年期,5年期的债券。并且保证long 5/short 7;Short 10/long 15这两组Long/short策略,各自组内达到Duration neutral(Money duration neutral)。但是本题更进一步地要求了4个position的Money Duration都相等,因此我们Short的最大头寸有:

10年期:200 million × 14.00 = 9.10 × 10-year bond

10-year bond = 307. 7million;

7年期: 200 million × 14.00 = 6.60 × 7-year bond

7-year bond = 424.24million;

对于本题,整个Condor策略的头寸为:

Long 5-year bond 577.32 million/short 7-year bond 424.24 million;Short 10-year bond 307.69 million/Long 15-year bond 200 million.

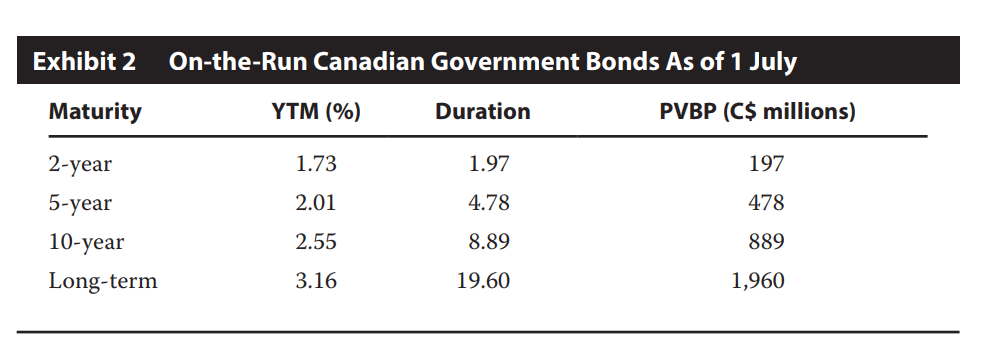

如果题目给的是PVBP数据,也可以算,如下图:

假设买Long-term债券的头寸是150million,每1个Million的PVBP是1960,所以买150million,Long-term获得的PVBP为:300×1960=294,000

Why do you use 300X1960, not 150X1960? Thank you!