NO.PZ201512300100000802

问题如下:

2. What is the stock’s justified trailing P/E based on the stock’s value estimated by Rae?

选项:

A.5.01.

B.5.24.

C.5.27.

解释:

A is correct.

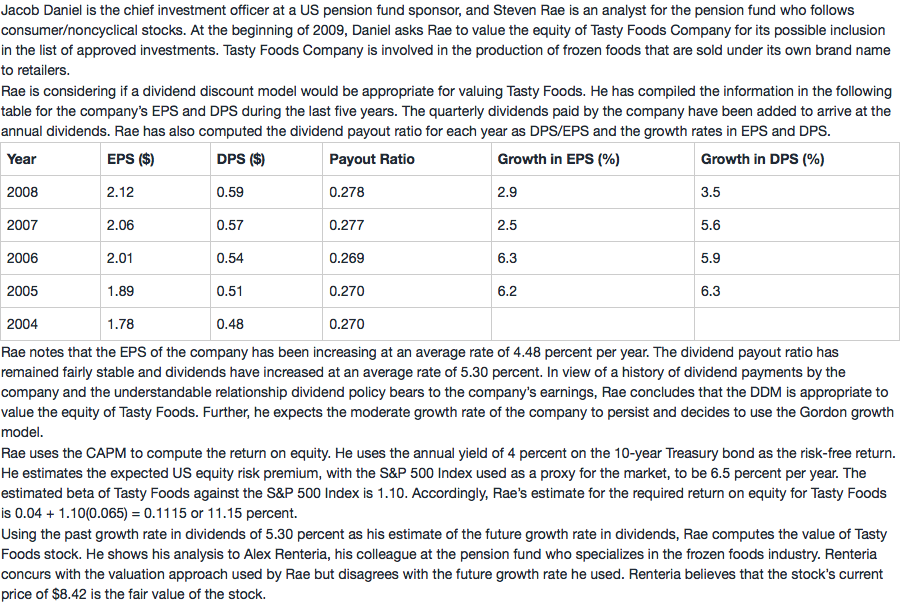

The justified trailing P/E or P0/E0is V0/E0, where V0 is the fair value based on the stock’s fundamentals. The fair value V0 computed earlier is $10.62 and E0 is $2.12. So, the justified trailing P/E is 10.62/2.12 = 5.01.

如果用1-b/r-g这个公示,G为什么不可以用2008年的DPS的增长3.5%呢?