NO.PZ2018101501000036

问题如下:

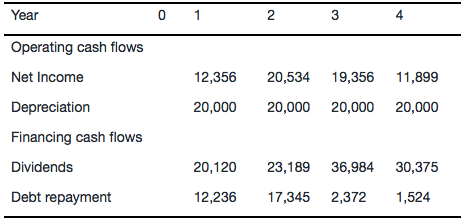

Anna is evaluating Company M which is going out of business in four years. The company is in the 25% tax bracket. The weighted average cost of capital and the cost of equity is 10% and 15%, respectively. The relevant distribution information is shown in the following cash flow statement. What is the value of equity at time zero?

选项:

A.113,696.29

B.85,988.53

C.76,714.45

解释:

C is correct.

考点:Other Valuation Models

解析:题目要我们求归属于股东的价值,只需将分配给股东的现金流( NI+Depreciation-principal repayment 即表格中Dividends)折现得到权益价值即可。

题目中CF to shareholder等于dividend是因为正好把所有NI分给了股东才导致的吗?