NO.PZ2020021205000061

问题如下:

A stock has an expected return of 15% and a volatility of 20%. The current price of the stock is USD 50, estimate 99% confidence for the price in six months.

选项:

解释:

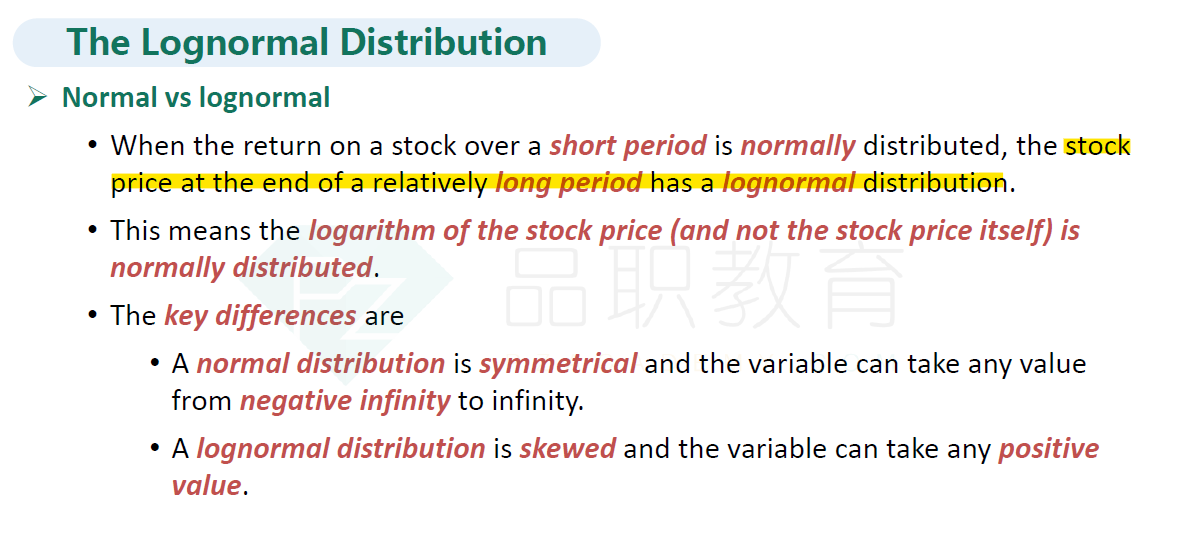

Here, the time period is longer, and we should work

with lognormal distributions. From Equations (15.2) and

(15.3), the logarithm of the stock price has mean:

ln(50) + (0.15 - /2) x 0.5 = 3.9770

and standard deviation:

0.2* = 0.1414

We are 99% certain that:

3.9770 - (0.995) x 0.1414 < ln(Sr) < 3.9770

+ (0.995) X 0.1414

or

3.6127 < ln(Sr) < 4.3413

so that:

< Sr <

or

37.1

St属于logN函数(s*e^ut,s^2*e*(2ut)*(e*(t*sigma^2)-1))?

1、可以用这个算吗?

2、用这个算完,均值是53.89?

3、用这个算完,方差是58.68?

4、如果上面3个都是对的,那左偏2.58个标准差后是34.16、右偏2.58个标准差后是73.63?

5、我真的搞不太懂ln(St)、St、R这三个分布的关系,就是什么时候题目用哪个?各自的分布中均值和方差我都知道,我也知道其实是可以互换的,可是感觉一道题目如果用不同的分布算出来的数字不一样呀!