NO.PZ2015120604000147

问题如下:

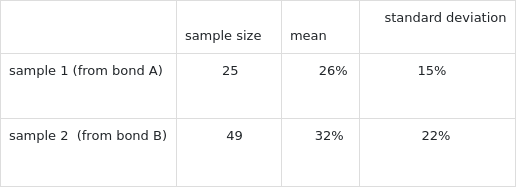

Here is a table discribing sample statistics from two bonds' rate of return which are both normally distributed over the past decades. If an investor is considering whether the mean of bond B is greater than 26%,

which of the following conclusion is least appropriate (significant level=5%) ?

选项:

A.It is approptiate to use the Z-test.

B.The mean of bond B is not significant greater than 26%.

C.It is a one-tailed test.

解释:

B is correct.

It is appropraite to ues the one-tailed Z-test because the sample size of bond B is bigger than 30.

The null hypothesis is: ≤

The test statistic:

α= 5% indicates the critical value is equal to ±1.65.

Because 1.91>1.65, therefore, we should reject the null hypothesis.

本题未var未知,是因为样本量大于30,所以用Z分布也可以,是么?