问题如下:

An analyst gathered the following information:

If the risk-free rate of return is 3.0 percent, the portfolio that had the best risk-adjusted performance based on the Sharpe ratio is:

选项:

A.

Portfolio 1.

B.

Portfolio 2.

C.

Portfolio 3.

解释:

B is correct.

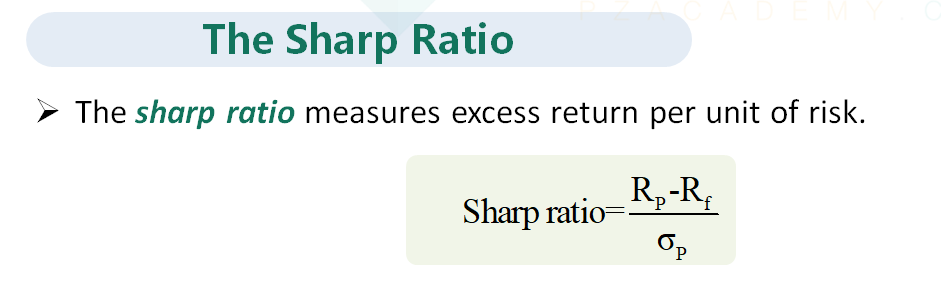

The Sharpe ratio is the mean excess return (mean return less risk-free rate of 3.0 percent) divided by the standard deviation of the portfolio. It is highest for portfolio 2 with a Sharpe ratio of 7.5/20.3 = 0.3695. For portfolio 1, the Sharpe ratio is 6.8/19.9 = 0.3417 and for portfolio 3 the Sharpe ratio is 10.3/33.9 = 0.3038.

为什么不需要把标准差2次方 变成方差?