NO.PZ2020021203000067

问题如下:

Does it become more likely that a put option will be exercised before maturity when (a) the interest rate increases and (b) the stock price increases?

选项:

解释:

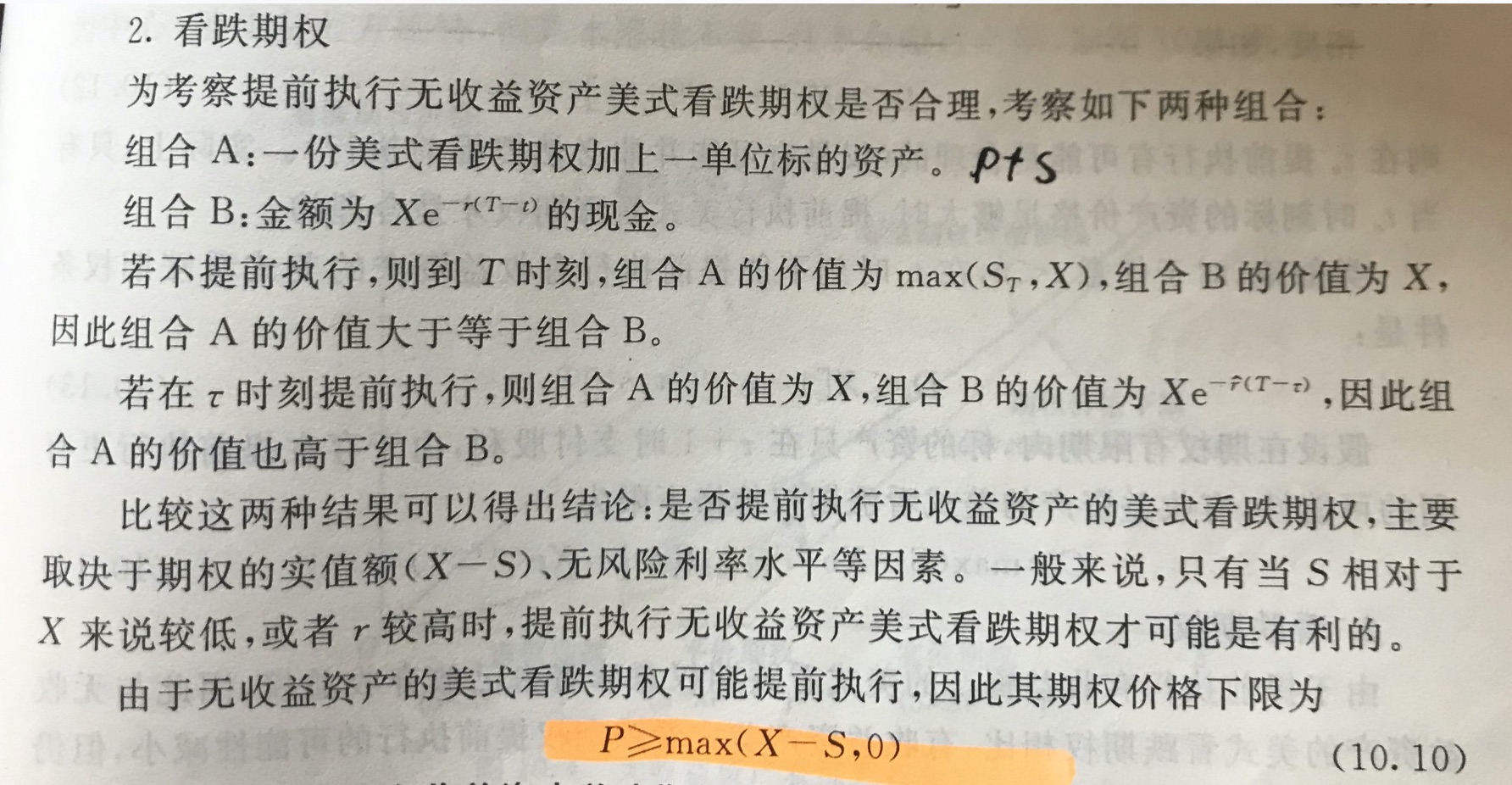

(a) When interest rates increase, the put option will be more likely to be exercised before maturity because the value of investing the profit at the risk-free rate after selling the stock at the strike price is increased. (b) When the stock price increases, the put option will be less likely to be exercised because the payoff from doing so will be smaller.

这道题是采用6因素吗?

那r和put不是负相关吗,怎么答案反了?

S和put是负相关,答案也对的上。