NO.PZ201710100100000201

问题如下:

1. Based on the information in Exhibit 1, the expected return for Portfolio 1 is closest to:

选项:

A.2.58%.

B.3.42%.

C.6.00%.

解释:

A is correct.

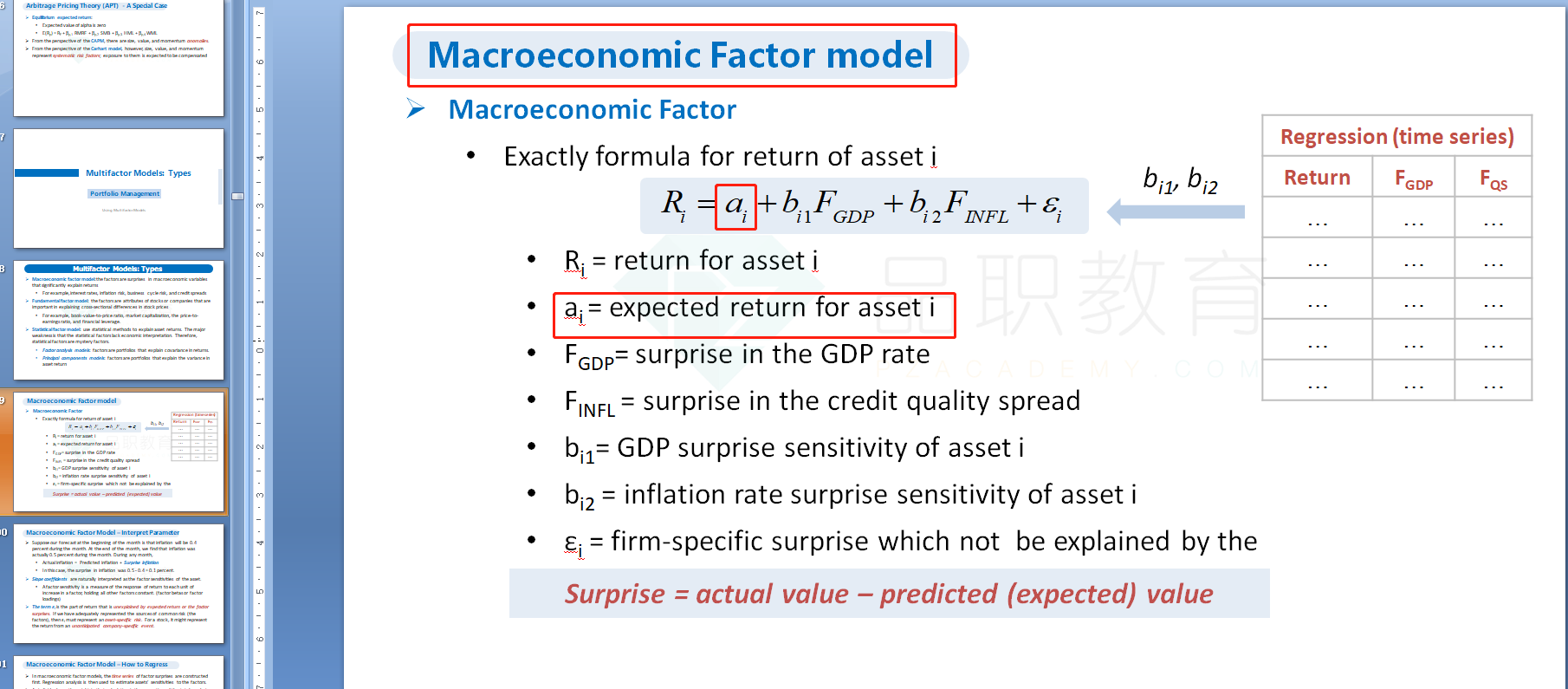

When using a macroeconomic factor, the expected return is the intercept (when all model factors take on a value of zero). The intercept coefficient for Portfolio 1 in Exhibit 1 is 2.58

考点:macroeconomic factor model

解析:宏观经济因子模型的expected return就是它的截距项。根据表格,Portfolio 1的截距为2.58,所以expected return=2.58%

为什么用expectedReturn=ActualReturn-Surprise得到的结果和截距项一样?这样算对么?还是只是巧合?那种方法正确?