NO.PZ201812020100000105

问题如下:

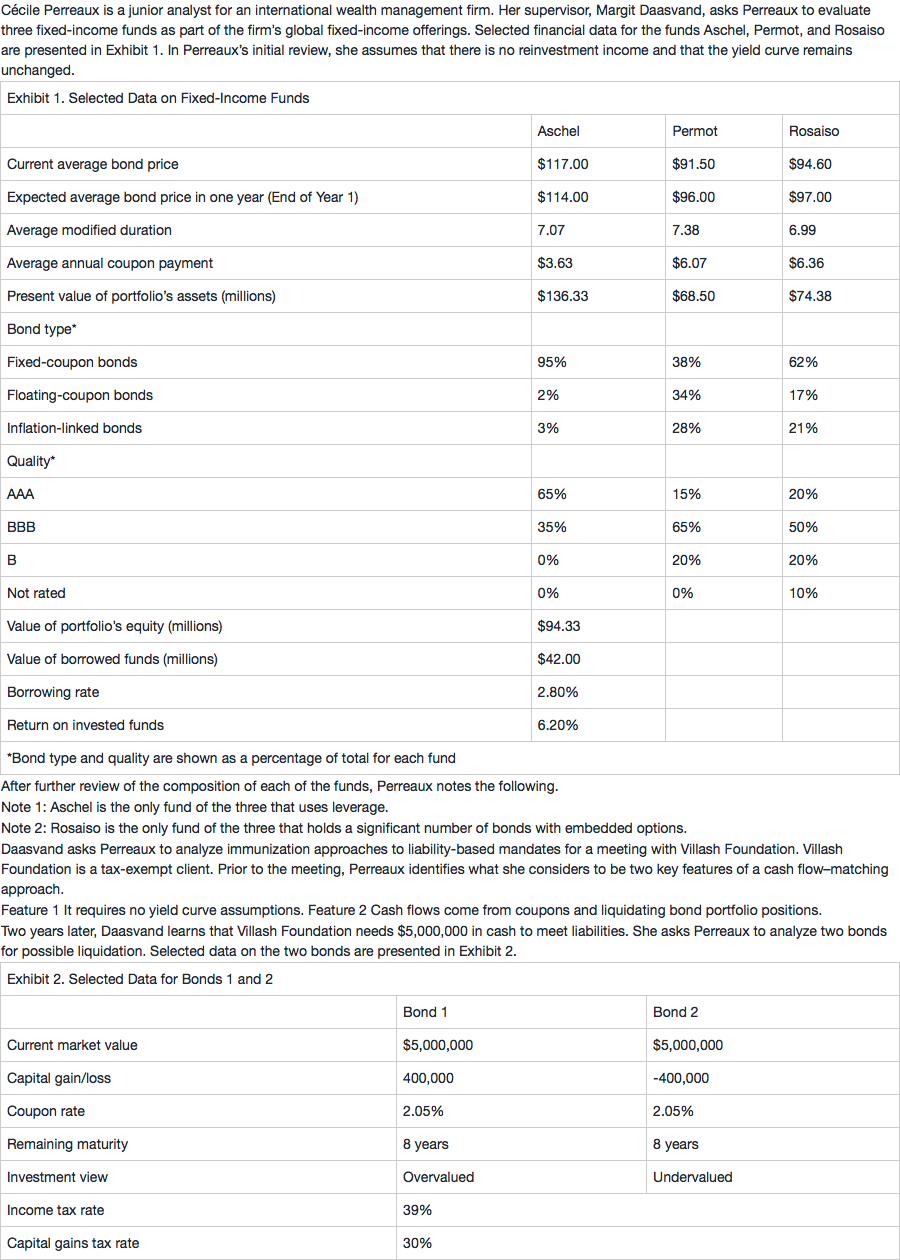

Is Perreaux correct with respect to key features of cash flow matching?

选项:

A.Yes.

B.No, only Feature 1 is correct.

C.No, only Feature 2 is correct.

解释:

B is correct.

Cash flow matching has no yield curve or interest rate assumptions. With this immunization approach, cash flows come from coupon and principal repayments that are expected to match and offset liability cash flows. Because bond cash inflows are scheduled to coincide with liability cash payouts, there is no need for reinvestment of cash flows. Thus, cash flow matching is not affected by interest rate movements. Cash flows coming from coupons and liquidating bond portfolio positions is a key feature of a duration-matching approach.

请问cash flow matching在现实操作中能做到每一笔都完美的match住liablitiy的现金流和日期么?我记得老师说过好像允许coupon提前于liability的日期,那这样会不会就有reinvestment risk了?