NO.PZ2018122701000092

问题如下:

A committee of risk management practitioner discusses the difference between pricing deep out-of-the-money call options on FBX stock and pricing deep out-of-the-money call options on the EUR/JPY foreign exchange rate using the Black-Scholes-Merton (BSM) model. The practitioners price these options based on two distinct probability distributions of underlying asset prices at the option expiration date:

- A lognormal probability distribution

- An implied risk-neutral probability distribution obtained from the volatility smile for options of the same maturity

Using the lognormal instead of the implied risk-neutral probability distribution will tend to:

选项:

A.Price the option on FBX relatively high and price the option on EUR/JPY relatively low.

B.Price the option on FBX relatively low and price the option on EUR/JPY relatively high.

C.Price the option on FBX relatively low and price the option on EUR/JPY relatively low.

D.Price the option on FBX relatively high and price the option on EUR/JPY relatively high.

解释:

A is correct.

考点Volatility Smile

解析

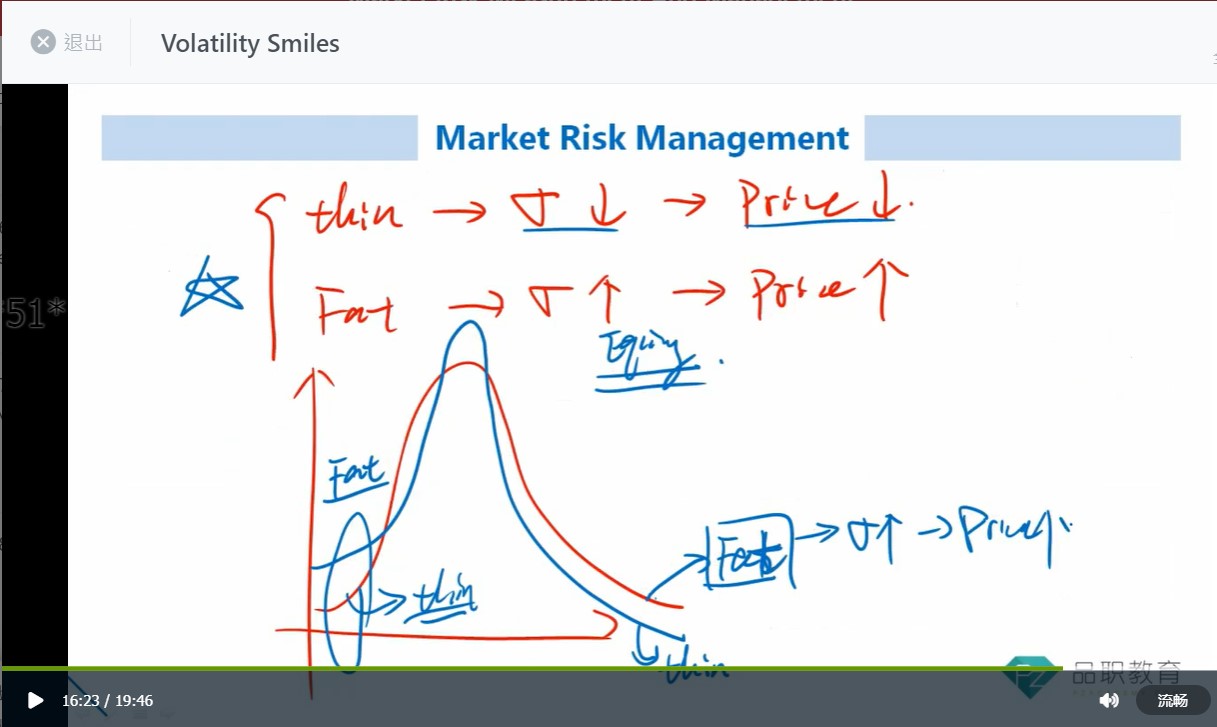

The implied distribution of the underlying equity prices derived using the general volatility smile of equity options has a heavier left tail and a less heavy right tail than a lognormal distribution of underlying prices. Therefore, using the lognormal distribution of prices causes deep-out-of-the-money call options on the underlying to be priced relatively high.

The implied distribution of underling foreign currency prices derived using the general volatility smile of foreign currency options has heavier tail than a lognormal distribution of underlying prices. Therefore, using the lognormal distribution of prices causes deep-out-of-the-money call options on the underlying to be priced relatively low.

我画了两种分布,就不传上来啦(要开pc端微信嫌麻烦hhh)

想跟老师确认一下图像,谢谢